Key Takeaways

- Preserves financial liquidity

- Leverages borrowed capital

- Secures large coverage

- Requires strong collateral

- Carries interest risk

Imagine getting a multi million dollar life insurance policy without paying the heavy premiums out of your own pocket, sounds surprising right? That is exactly what premium financing life insurance makes possible. Instead of draining savings or interrupting investments, high net worth individuals and business owners use the smart financing to let a lender pay the premiums while they keep their cash working elsewhere.

In this comprehensive guide, we will explain about the premium financing life insurance, also how it works, what are the benefits, the risks and also the structure behind these financing arrangements. We will also look at the life insurance premium financing companies, strategies and common problems you should know before choosing this path.

Basic Understanding Of Premium Finance Life Insurance

Premium financing life insurance that is also called premium financing of life insurance is a financial strategy where the policyholder uses a loan to pay for the large life insurance premiums instead of paying from personal cash flow.

The strategy especially common for

- High net worth individuals

- Business owners

- Families needing estate liquidity

- People requiring multi million dollar policies

- Wealthy individuals looking to preserve cash for investment

- Trusts often irrevocable life insurance trusts

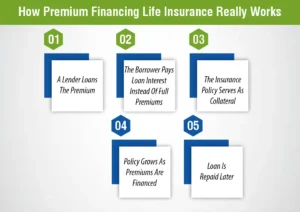

How Premium Financing Life Insurance Really Works

Understanding how life insurance premium financing works required looking at all the components that are involved

A Lender Loans The Premium

A bank or Financing company gives you a loan. This loan is only used to pay your life insurance premiums.

The Borrower Pays Loan Interest Instead Of Full Premiums

Instead of paying the big premium yourself, you just pay the interest on the loan. This will make it much cheaper out of your own pocket.

The Insurance Policy Serves As Collateral

The lender uses the policies, cash value as security. Sometimes you only need to add extra collateral depending on the loan size.

Policy Grows As Premiums Are Financed

As the premiums are paid, the policy cash value increases and this growth can later help to repay the loan.

Loan Is Repaid Later

There are two ways to repay the loan back, the first is the loan is paid from the death benefit after death, and the second is you can pre-pay it using the policy cash value, your assets or by refinancing while you are alive.

Why People Use Financing Life Insurance Premiums

Individual choice financing life insurance premiums is to access the large insurance coverage without selling the assets or interrupting the investment strategies. There are so many wealthy business owners who have their money tied up in real estate, businesses or long-term investments. Rather than liquidating the assets they use the premium financing for life insurance to keep their capital working while still securing a policy worth millions.

Benefits Of Life Insurance Premium Finance

Using premium financing life insurance offers you so many advantages especially for wealthy families and businesses. Let’s have a look at some of the benefits of how this will be the best for wealthy individuals and business owners.

Preserves Liquidity

Instead of paying millions in premiums the client pays on loan interest and maintains access to capital.

Leverage And Wealth Growth

Premium financing will allow the clients to leverage existing wealth while keeping the investments that may grow faster than the borrowing cost.

Estate Planning Advantages

Large policies can be used to pay the future estate taxes and make sure that heirs receive more of the estate.

Access To Large Coverage

Clients get secured high benefits without any major cash flow disruption.

Trust And Business Use

It works extremely well with ILITs, business buy sell agreement, and key person insurance.

How Much Does Life Isurance Cost?

Life Insurance Premium Financing Companies And Lenders

There are so many types of life insurance premium financing companies and lenders that are offering these loans. Lets have a general information of these

Traditional Banks

Some banks have departments that are specially dedicated to high net worth premium financing

Private Premium Financing Life Insurance Firms

These firms specialises in servicing large cases and offer the custom loan-structures

Non Recurse Premium Financing Life Insurance Providers

Non-resource lenders limit the borrower’s liability. If the loan is not repaid only the collateral policy cash value is at risk.

Life Insurance Premium Finance Lenders For Universal Life Policies

These lenders specifically offered the financing for universal life insurance premium financing structures

Premium Financed Life Insurance Companies

Some of the insurance companies partner with lenders to simplify the process for clients

Premium Financing Whole Life Insurance Vs Universal Life

You can finance premiums for both policy types. Let’s have a look at how we can work and why universal life is generally preferred for premium financing.

Whole Life Insurance

- The plan provide the stable guaranteed cash value growth

- Predictable performance

- High collateral requirements

Universal Life Insurance

- Flexible premiums

- Potential for higher returns

- Often used in universal life insurance premium financing strategies

Life Insurance Premium Financing Structure

A successful life insurance premium financing structure generally include the following things

- A large permanent policy UL or whole life insurance

- A Lender providing the premium loan

- An ILIT or business owner as policy owner

- Collateral policy cash value plus outside assets

- A Long-term exit strategy

- Financial stress testing

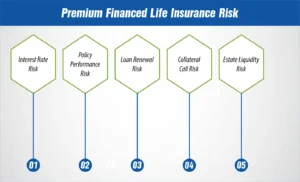

Premium Financed Life Insurance Risk

All the premium financing offers the major benefit it also comes with some major risks

Interest Rate Risk

Loans used to finance the premiums often have variable interest rates. Rising rates can increase the cost.

Policy Performance Risk

If policy cash paid under performs, then more collateral can be required

Loan Renewal Risk

Lenders typically review the loan annually. They may adjust the premium or decline the renewals

Collateral Call Risk

Clients may have to provide the additional assets if policy value decreases

Estate Liquidity Risk

If not structured properly heirs may face challenges paying off the loan.

Is Premium Financing Life Insurance A Good Choice?

Premium financing life insurance is best for individuals with a net worth of $2 million-$5 million and for the people who want to avoid liquidating investments. This plan is also best for the clients with strong credit and stable income and those who need multi-million dollar estate planning coverage.

Final Thoughts

Premium financing life insurance is a powerful financial tool that will allow the high net worth individuals to obtain the large life insurance policies without using the significant personal capital. Understanding what premium financial life insurance is very important and when structured correctly and managed by the experienced advisors it can offer the tax advantages, preserve liquidity, support state planning and create intergenerational wealth.

If you are considering the premium financing for life insurance, make sure that you work with a reputable life insurance premium financing company and lenders who understand the complexities of this strategy.

We Are Here to Listen and Serve

At M-life Insurance We are here to listen and serve you with the best possible Life insurance policies specially designed for your needs and preferences. Get a free quote now and buy the plan that fits your budget with Mlife Insurance.

FAQS

The main disadvantage is risk. If interest rates go up or the policy does not grow as expected, then you may have to pay more money to provide extra collateral to keep the loan safe.

Premium financing means that you are borrowing money from a lender to pay life insurance premiums instead of paying from your own pocket.

It is a plan where you use a loan to pay big life insurance premiums, keep your own money free and pay back the loan letter using the policies cash value or death benefit.

Premium payment is simply the amount of money you paid to keep your life insurance policy active. It can be paid monthly, yearly or as a lump sum.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.