Life insurance is a crucial part of financial planning, providing a safety net for your loved ones in case the unexpected happens. However, determining the right amount of coverage can be challenging. This is where the Nationwide Life Insurance Calculator comes in.

This handy tool helps you estimate how much coverage you need based on your unique circumstances. By taking into account factors like your income, debts, and future expenses, the calculator provides an accurate estimate of your coverage needs.

In this guide, we’ll explore how to use the Nationwide Insurance Calculator effectively and why it’s important to get the right coverage. Whether you’re new to life insurance or looking to review your existing coverage, the Nationwide Insurance Calculator can help you make informed decisions about your financial future.

Understanding the Nationwide Life Insurance Calculator

The Nationwide Insurance Calculator is a user-friendly online tool that helps you estimate how much life insurance coverage you may need based on your financial situation. To use the calculator, you’ll need to provide information such as your age, annual income, existing debts, and future financial goals. The calculator then uses this information to generate an estimate of your life insurance needs.

Factors Considered in the Calculation

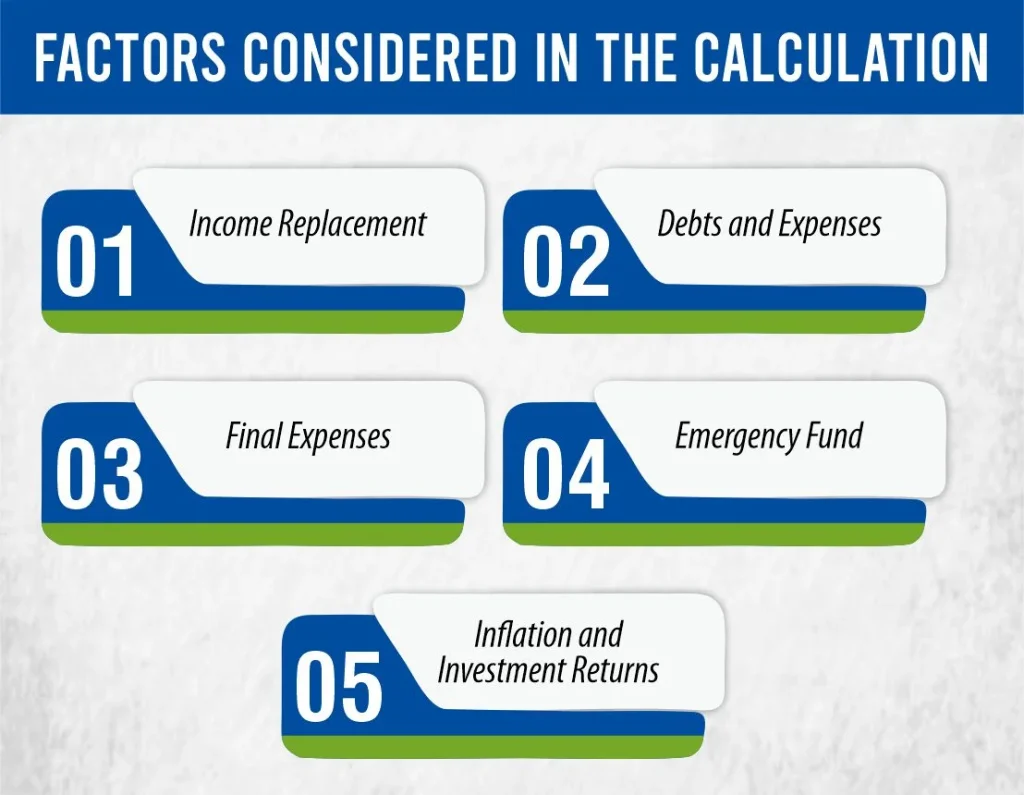

Several crucial factors are considered in the calculation process of the Nationwide Life Insurance Calculator. These factors ensure that the estimate provided aligns closely with your unique financial situation and needs.

Here’s a breakdown of the key factors:

- Income Replacement

The calculator assesses how much of your income would need to be replaced to maintain your family’s standard of living if you were no longer around. This factor considers your current income and the financial support your family relies on.

- Debts and Expenses

Your existing debts, such as mortgages, car loans, and credit card debt, are taken into account. Additionally, future expenses like college tuition for your children or ongoing financial obligations are considered to provide a comprehensive overview.

- Final Expenses

The calculator estimates the cost of your final expenses, including funeral and burial costs. This factor ensures that these immediate financial burdens are covered without placing additional strain on your loved ones.

- Emergency Fund

Setting aside an emergency fund is crucial to cover unexpected expenses. The calculator may recommend allocating a portion of your coverage amount to ensure financial stability in unforeseen circumstances.

- Inflation and Investment Returns

To safeguard against the impact of inflation and optimize your coverage over time, the calculator adjusts for inflation and considers potential investment returns. This ensures that your coverage amount remains adequate as your financial circumstances evolve.

By considering these factors, the Nationwide Insurance Calculator provides a comprehensive estimate tailored to your individual needs. This holistic approach enables you to make informed decisions about your life insurance coverage, providing peace of mind for you and your loved ones.

How to use the Nationwide Life Insurance Calculator?

Using the Nationwide Insurance Calculator is a straightforward process that can help you estimate the amount of coverage you may need. Here’s a step-by-step guide to using the calculator:

Visit the Nationwide Website: Start by visiting the Nationwide website and navigating to the life insurance section. Look for the Life Insurance Calculator tool.

Launch the Calculator: Click on the calculator tool to launch it. The calculator will typically be a web-based form that you can fill out with your information.

Enter Your Information: The calculator will ask you to enter specific information about yourself and your financial situation. This may include your age, gender, annual income, existing debts, and any other relevant details.

Review the Estimated Coverage Amount: Based on the information you provided, the calculator will generate an estimated coverage amount. This is the amount of life insurance coverage it recommends for your needs.

Adjust the Coverage Amount (if necessary): You can adjust the coverage amount based on your specific needs and circumstances. For example, you may want to increase the coverage amount if you have dependents or significant debts.

How Much Does Life Isurance Cost?

Contact a Nationwide Insurance Agent: Once you have an estimated coverage amount that you’re comfortable with, consider contacting a Nationwide insurance agent. They can provide you with more information about your coverage options and help you get a personalized quote.

Review Your Coverage Regularly: Life insurance needs can change over time, so it’s important to review your coverage regularly. Consider using the Nationwide Insurance Calculator periodically to ensure that your coverage amount aligns with your current financial situation and goals.

By using the Nationwide Life Insurance Calculator, you can get a better understanding of your life insurance needs and make an informed decision about your coverage. Remember, life insurance is an important financial tool that can provide peace of mind knowing that your loved ones will be taken care of financially in the event of your passing.

How much Coverage do you need with Nationwide Life Insurance?

Determining the amount of coverage you need with Nationwide Life Insurance depends on various factors such as your age, income, debts, and financial goals. Below is a general guideline to help you estimate your coverage needs based on your annual income:

| Annual Income | Recommended Coverage |

| $50,000 | $500,000 – $1,000,000 |

| $75,000 | $750,000 – $1,500,000 |

| $100,000 | $1,000,000 – $2,000,000 |

| $150,000 | $1,500,000 – $3,000,000 |

| $200,000 | $2,000,000 – $4,000,000 |

| $250,000 | $2,500,000 – $5,000,000 |

These estimates are based on the general rule of thumb that your life insurance coverage should be 10 to 15 times your annual income. However, individual circumstances may vary, and it’s essential to consider factors such as outstanding debts, future expenses, and any additional financial responsibilities when determining your coverage needs.

For a more accurate assessment, consider using the Nationwide Life Insurance Calculator, which takes into account your specific financial situation to provide a personalized coverage recommendation.

Why You Need the Right Coverage?

Having the right amount of life insurance coverage is crucial to ensuring your family’s financial security in the event of your passing. If you’re underinsured, your loved ones may struggle to meet their financial obligations, such as mortgage payments, bills, and daily expenses. This can lead to significant financial hardship and stress during an already difficult time. On the other hand, if you’re overinsured, you may be paying more in premiums than necessary, which can strain your budget.

The right coverage can provide peace of mind knowing that your loved ones will be taken care of financially, allowing them to maintain their standard of living and achieve their future goals. It can also help cover immediate expenses such as funeral costs and outstanding debts, relieving your family of financial burdens during a challenging time. Additionally, life insurance proceeds are generally tax-free, providing your beneficiaries with a financial cushion without added tax implications.

By ensuring you have the right amount of coverage, you can protect your family’s financial future and provide them with the support they need to move forward confidently.

Final Thoughts

The Nationwide Life Insurance Calculator is a powerful tool that can help you determine the right amount of coverage you need to protect your family’s financial future. By taking into account factors such as your income, debts, and future expenses, the calculator provides an accurate estimate of your coverage needs. Whether you’re just starting to explore life insurance options or reviewing your existing coverage, the Nationwide Insurance Calculator can help you make an informed decision.

Frequently Asked Questions (FAQs)

1- How often should I review my life insurance coverage using the calculator?

It’s a good idea to review your life insurance coverage annually or whenever there are significant changes in your life, such as marriage, the birth of a child, or a change in income. This ensures that your coverage remains adequate for your needs.

2- Does the Nationwide Life Insurance Calculator consider my health status?

While the Nationwide Insurance Calculator does not directly consider your health status, your health can impact the cost of your life insurance policy. It’s important to disclose any relevant health information when applying for life insurance.

3- Can I use the calculator if I’m not a Nationwide customer?

Yes, the Nationwide Life Insurance Calculator is available for anyone to use, regardless of whether they are currently a Nationwide customer or not. It’s a helpful tool for anyone considering life insurance coverage.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.