Preparing for the inevitable is a profound yet necessary aspect of life. None of us can escape the reality of our mortality, but what we can do is ensure that our departure doesn’t add unnecessary financial stress to those we leave behind.

MetLife, a trusted name in insurance, steps in with a thoughtful solution: burial insurance. You can take this insurance as a safety net, designed to embrace your loved ones during a challenging time.

In this blog post, we’ll take a closer look at MetLife’s burial insurance – a comprehensive safety blanket crafted to cover final expenses. Let’s explore how MetLife eases the burden by providing accessible, affordable, and reliable options tailored to ensure a dignified farewell without adding financial strain to your family.

MetLife Insurance Review

MetLife Insurance refers to the range of insurance products and services offered by MetLife, a prominent global insurance provider. Established in 1868, MetLife has evolved into one of the leading insurance companies, offering a wide array of insurance solutions to individuals, families, and businesses worldwide.

It encompasses various types of coverage, including life insurance, health insurance, dental insurance, disability insurance, retirement planning, and employee benefits. The company caters to diverse needs, providing policies that offer financial protection, security, and peace of mind to policyholders and their beneficiaries.

MetLife’s insurance products are designed to address different stages of life, offering customizable options to meet specific requirements. Whether it’s safeguarding loved ones’ futures, planning for retirement, or ensuring comprehensive health coverage, MetLife strives to provide reliable and innovative insurance solutions tailored to individual needs.

Does MetLife Offer Burial Insurance?

Yes, MetLife does offer burial insurance, also known as final expense insurance. MetLife recognizes the importance of helping individuals and families plan for end-of-life expenses without burdening their loved ones. Burial insurance from MetLife is specifically designed to cover the costs associated with funerals, cremation, or other final expenses that may arise after someone passes away.

MetLife’s burial insurance policies typically provide coverage for funeral and burial expenses, including costs for caskets, urns, memorial services, cremation, burial plots, and other related fees. These policies are often designed to be more accessible and have relatively lower coverage amounts compared to traditional life insurance policies, making them a practical choice for individuals seeking to ensure their end-of-life expenses are covered without leaving a financial burden on their families.

What is MetLife Burial Insurance Cost?

The cost of MetLife burial insurance varies based on the coverage amount selected, the age of the insured individual, their health status, and the specific plan chosen. Generally, policies with higher coverage amounts or for older individuals may have slightly higher monthly premiums.

Here’s a tabular representation of Metlife Burial insurance cost varying on different ages and coverage amounts:

| Age Range | Coverage Amount | Monthly Premium |

| 50 – 55 | $5,000 | $30 – $50 |

| 56 – 60 | $7,500 | $40 – $60 |

| 61 – 65 | $10,000 | $50 – $80 |

| 66 – 70 | $15,000 | $70 – $110 |

| 71 – 75 | $20,000 | $90 – $150 |

Remember, these figures are indicative and can vary significantly based on individual circumstances and the specific MetLife insurance plan chosen. It’s advisable to consult with a MetLife representative for personalized quotes based on your situation.

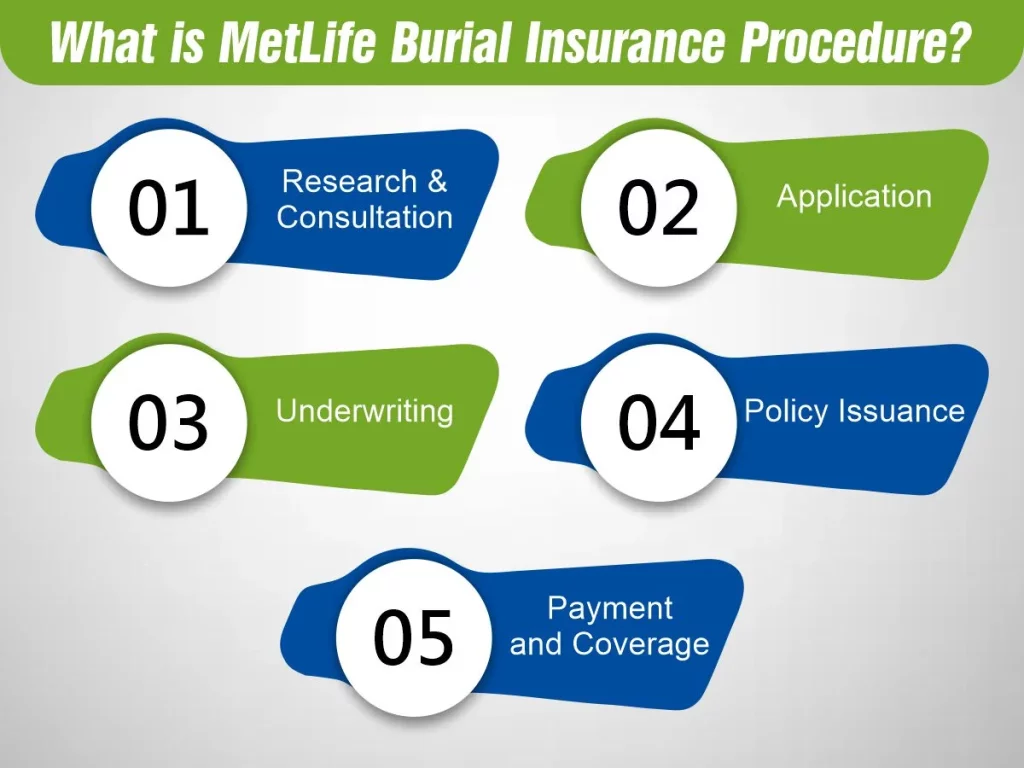

What is MetLife Burial Insurance Procedure?

The process to acquire MetLife Burial insurance involves several key steps:

1. Research and Consultation

Begin by researching MetLife’s burial insurance offerings. Understand the available plans, coverage options, and associated costs. You can visit MetLife’s website or contact their representatives for detailed information.

How Much Does Life Isurance Cost?

2. Application

Once you’ve chosen a plan that suits your needs, proceed with the application process. You’ll need to provide personal information, such as your name, address, date of birth, and possibly some health-related questions, depending on the plan.

3. Underwriting

MetLife will review your application to assess eligibility and determine the premium based on factors such as age, health status, coverage amount, and risk assessment. This step may involve a medical questionnaire or exam in certain cases.

4. Policy Issuance

Upon approval, MetLife will issue the burial insurance policy. You become a policyholder and receive the policy documentation outlining coverage details, premiums, terms, and conditions.

5. Payment and Coverage

Make payments according to the policy terms to keep it active. Once the policy is in force, it provides coverage for the specified final expenses according to the plan’s terms and conditions.

It’s essential to review all documents carefully, understand the coverage, and keep the policy updated to ensure your end-of-life expenses are adequately covered. For personalized guidance, consult with MetLife’s representatives throughout the application process.

What Does MetLife Burial Insurance Cover?

MetLife burial insurance, also known as final expense insurance, typically covers various end-of-life expenses, providing financial support to your loved ones after your passing. While specific coverage details can vary based on the policy and plan chosen, here are the general expenses often covered by MetLife insurance:

1- Funeral and Burial Expenses

- Caskets or Urns: Costs associated with purchasing a casket or urn for burial or cremation.

- Embalming and Preparation: Fees for embalming, dressing, and preparing the deceased for the funeral service.

- Funeral Service Costs: Expenses related to the funeral or memorial service, including venue rental, transportation, and clergy fees.

- Cremation or Burial: Coverage for cremation or burial costs, including cemetery fees or crematory charges.

2- Medical Bills

- Outstanding Medical Expenses: Settling any unpaid medical bills or healthcare-related costs.

3- Debts and Loans

- Outstanding Debts: Helping to pay off any remaining debts or loans left behind by the deceased, such as credit card balances or personal loans.

4. Other Final Expenses

Probate Costs: Assistance with probate fees or legal costs associated with settling the deceased’s estate.

MetLife’s final expense insurance aims to ease the financial burden on your family during a difficult time by covering these final expenses. It offers peace of mind, ensuring that your loved ones can focus on honoring your memory without worrying about the financial implications of your passing. It’s crucial to review the specific policy terms and conditions to understand the exact coverage provided by your MetLife insurance plan.

How Do You Check Your MetLife Burial Policy Details?

Checking your MetLife insurance policy details can be done through various methods:

1- Online Access

MetLife Account: Log in to your MetLife account on their official website. Navigate to the policy section, where you can view detailed information about your burial insurance policy. You can access policy details, coverage amounts, premium payments, and beneficiary information online.

2- Customer Service

Helpline: Contact MetLife’s customer service helpline. Representatives can assist in providing policy details, answering queries, and guiding you through the process of understanding your burial insurance policy.

3- Policy Documents

Policy Papers: Refer to the physical or digital copy of your burial insurance policy documents. They contain comprehensive information about the coverage, terms, conditions, beneficiaries, and other essential policy details.

4- Agent or Financial Advisor

MetLife Representative: If you have an assigned MetLife agent or financial advisor, reach out to them. They can provide personalized assistance and explanations regarding your burial insurance policy.

5- Mobile Apps

MetLife Mobile App: If available, use the MetLife mobile app to access your policy details on your smartphone or tablet. Some insurance providers offer apps that allow policyholders to check details conveniently.

Ensure you have necessary information, such as your policy number, when accessing your burial insurance policy details through these channels. Reviewing your policy regularly and staying informed about its terms and coverage can help you make informed decisions and ensure your coverage aligns with your needs.

Conclusion

Planning for the end of life is a responsible decision that alleviates the financial strain on loved ones. MetLife burial insurance provides a reliable solution to ensure that your final expenses are covered without burdening your family during a challenging time.

With its range of affordable plans and commitment to customer satisfaction, MetLife stands as a dependable choice for securing peace of mind and a dignified farewell. Consider exploring MetLife’s burial insurance options to safeguard your loved ones’ future today.

Frequently Asked Questions (FAQs)

1- What exactly is burial insurance from MetLife?

MetLife burial insurance, or final expense insurance, is a policy designed to cover the costs associated with funerals, cremation, or other final expenses that arise after someone passes away. It provides financial support to ease the burden on loved ones during difficult times.

2- How does MetLife burial insurance differ from traditional life insurance?

Unlike traditional life insurance policies, MetLife insurance typically offers lower coverage amounts and is more accessible. It focuses specifically on covering end-of-life expenses, such as funeral costs, medical bills, outstanding debts, and other final expenses.

3- Can anyone apply for MetLife final expense insurance?

Yes, MetLife offers burial insurance plans that cater to a wide range of age groups. However, eligibility and premiums may vary based on factors like age, health status, coverage amount, and specific plan chosen.

4- Is MetLife burial insurance a suitable option for ensuring my family’s financial security after I’m gone?

MetLife insurance offers a practical and accessible way to ensure that your final expenses are covered without burdening your family. It aims to provide peace of mind during challenging times.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.