Introduction

Lincoln Heritage Funeral Advantage is a popular funeral insurance and planning program designed to help families manage funeral and cremation expenses with confidence. Commonly known as the Funeral Advantage program, it combines life insurance coverage with professional funeral planning assistance.

This guide explains how the program works, its benefits, cost, reviews, legitimacy, and how it supports seniors and families during difficult times.

What Is Lincoln Heritage Funeral Advantage?

Lincoln Heritage Funeral Advantage is a funeral insurance program offered by Lincoln Heritage Life Insurance Company. The program provides a life insurance policy along with access to funeral planning services that help families prepare in advance.

What Is a Funeral Advantage?

Funeral Advantage is a service that assists families by combining insurance benefits with funeral planning guidance, helping reduce financial stress and confusion during loss.

How the Funeral Advantage Program Works

The funeral advantage program operates through two essential components that work together.

Life Insurance Coverage

Policyholders receive funeral advantage life insurance, which pays a cash benefit to beneficiaries upon death. This benefit can be used to cover funeral, burial, or cremation expenses.

Funeral Planning Assistance

The program provides access to professionals who help families:

- Compare funeral prices

- Locate advantage funeral home locations

- Coordinate advantage funeral and cremation services

This guidance helps families make informed decisions during emotional times.

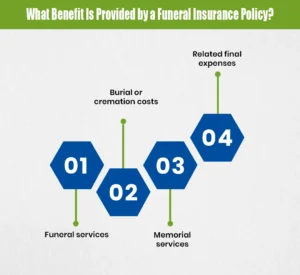

What Benefit Is Provided by a Funeral Insurance Policy?

A funeral insurance policy provides a payout designed to cover end-of-life expenses.

Covered Benefits Include

- Funeral services

- Burial or cremation costs

- Memorial services

- Related final expenses

What Is the $40,000 Burial Benefit?

The $40,000 burial benefit refers to a possible maximum coverage amount offered by some funeral insurance policies. Actual benefit amounts depend on age, health, and policy selection.

Funeral Advantage Program for Seniors

The funeral advantage program assists seniors by offering simplified enrollment and long-term protection.

Why Seniors Choose the Program

- No medical exam options

- Fixed monthly premiums

- Lifetime coverage

- Funeral planning support

The funeral advantage program for seniors is designed to be affordable and accessible, especially for individuals on fixed incomes.

Advantage Funeral Homes & Services

The program works closely with advantage funeral and cremation providers nationwide.

Advantage Funeral Home Services

Services commonly include:

- Traditional funeral services

- Cremation services

- Memorial ceremonies

- Pre-planning assistance

Advantage Funeral Home Locations

Families often search for:

- Advantage Funeral Home Tulsa

- Advantage Funeral Home Chattanooga

- Advantage Funeral Home Fort Wayne

Many also look for advantage funeral home obituary and advantage funeral home obituaries to find service details.

Funeral Advantage Reviews & Program Legitimacy

Is the Funeral Advantage Program Legitimate?

Yes, the program is widely considered legitimate due to its long-standing association with Lincoln Heritage Life Insurance Company.

How Much Does Life Isurance Cost?

Funeral Advantage Reviews

Funeral advantage reviews and Lincoln Heritage funeral advantage reviews often highlight:

- Helpful planning support

- Predictable costs

- Timely claim processing

Individual experiences may vary based on policy terms.

Funeral Advantage Program Cost

The funeral advantage program cost varies depending on several factors.

Cost Factors Include

- Age at enrollment

- Coverage amount

- Health history

Premiums are typically fixed and paid monthly, making budgeting easier for policyholders.

Lincoln Heritage Funeral Advantage Access & Support

Policyholders can manage their program through multiple support options.

Customer Access Options

- Lincoln Heritage Funeral Advantage phone number for assistance

- Lincoln Heritage Funeral Advantage login for account access

- Funeral Advantage en Español for Spanish-speaking families

These options ensure support is available when needed.

Advantages and Disadvantages of Funeral Insurance

Advantages of Funeral Insurance

- Helps cover funeral and cremation costs

- Reduces financial burden on loved ones

- Provides peace of mind

What Are the Disadvantages of Funeral Insurance?

Potential disadvantages include:

- Limited coverage amounts

- Long-term premium payments

- Not ideal for all financial situations

Understanding both sides helps families make informed decisions.

Conclusion

Lincoln Heritage Funeral Advantage offers a combination of funeral insurance and planning assistance designed to ease emotional and financial stress. Through the funeral advantage program, families gain access to insurance benefits, funeral service coordination, and professional guidance.

Plan ahead with confidence and protect your loved ones from unexpected costs.

M-Life Insurance offers reliable funeral insurance solutions and expert guidance to help you secure peace of mind contact M-Life Insurance today to learn more.For seniors and families seeking predictable funeral coverage and structured planning support, funeral advantage insurance can be a practical solution when carefully selected.

FAQS

It refers to a possible maximum payout amount offered by certain funeral insurance policies, depending on eligibility and coverage.

Limited coverage, long-term premium costs, and suitability depending on personal financial needs.

Yes, Lincoln Heritage pays benefits according to policy terms once a valid claim is submitted.

It provides financial assistance to cover funeral, burial, or cremation expenses.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.