When it comes to securing your family financial future, whole life insurance is one of the best and the best options that is available. This plan is not the same as a life insurance policy because term life expires, but the whole life insurance provides lifelong coverage and guaranteed death benefit. Plus it builds cash value over time. But how do you find the best life insurance quote for the whole life policy? In this article we will guide you through everything you need to know including how to compare the policies, where to get the affordable and cheap life insurance quotes for whole life policy, and how to understand your coverage options.

What Is A Whole Life Insurance Policy?

The whole life insurance policy is a kind of insurance that lasts your whole life. It does not end after a few years like other plans. Also, this plan serves some money for you that grows over time. You can borrow this money or take it out if you need it.

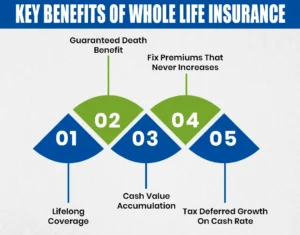

Key Benefits Of Whole Life Insurance

There are some key benefits when you buy the life insurance quotes for whole life policy.

Lifelong Coverage

Your insurance will stay active for your entire life, as long as you keep paying the monthly or yearly amount

Guaranteed Death Benefit

When you pass away, your family will definitely get the money promised by the insurance company.

Cash Value Accumulation

Overtime, your policy will have some extra money that you can use while you are

Fix Premiums That Never Increases

The amount you pay for your insurance will stay the same and will not go up over

Tax Deferred Growth On Cash Rate

The extra money policy will have risen without being taxed until you take it off.

Why Get Life Insurance Quotes For a Whole Life Policy?

Getting a different life insurance quotes for whole life policy is the best and the smartest way to make sure that you are getting the best option life insurance rate can change between providers and the wrong choice can cause you thousands of dollars over the life of the policy.

Benefits of getting whole life insurance quotes

Compare Coverage Options And Rates

You can see what each plan can offer and how much it cost, so you can choose the best one for you

Find Affordable Life Insurance Quotes For Whole Life Policy

You can find a plan that fits your budget and that is not too expensive

Understand What Is Included In Each Policy

You will know exactly what you are getting with each plan, like how much your family will get and what extra benefits are included

Your Policy To Match Your Financial Goals

You can pick a plan that fits your money needs, no matter what you want like if you are saving money you want to protect your family or you want both

How To Get Life Insurance Quotes For Whole Life Policy Online

Thanks to the Internet you can now easily check and compare the life insurance quotes for whole life policy online from trusted companies and there are also some agents who can help you to get the right one. Most websites only need a few details from you and It will show you your quotes in just a few minutes

Simple Steps To Get Whole Life Insurance Quotes Online

- Make sure to go to the trusted insurance website, use a website that compares insurance from different companies

- Fit in your basic information like your age, your gender and health details.

- Always make sure to pick how much coverage you want, choose the amount of money you want your family to get and how much you want to pay.

- See your course right away the website will show you offers from different insurance companies

- Compare your options, for that you have to look at the price benefits and how strong and reliable each company is.

Comparing Whole Life Insurance Quotes

When you compare life insurance quotes for a whole life policy, it is very important to look at the prices. A low premium may come with limited benefits or poor customer service. Here is what you watch whenever you are comparing the quotes. Let’s have a look at what you have to compare.

How Much Does Life Isurance Cost?

- Coverage amount

- Monthly/annual premium

- Policy fees

- Riders are additional benefits.

- Cash value growth rate

- Company ratings and reviews

Affordable Whole Life Insurance Quotes – How To Save

Whole life insurance usually costs more than term life insurance, but you can still find affordable quotes if you know how. Let’s have a look at easy tips that will lower your whole life insurance cost so that it is easy to get the plan at easy prices.

- By the plan when you are young because the younger you are the cheaper your monthly premiums will be.

- Always stay healthy because if you don’t smoke anywhere in good health, you will pay less.

- Pick a smaller death benefit, and if money is tight, choose a lower payout amount to keep the cost down.

- Get help from the broker because the broker can help you find the best insurance from the different insurance companies

- You can use an online calculator for online whole life insurance policy quotes because a whole life insurance cost calculator can help you to see how much your policy will cost.

Best whole life insurance quotes- what to look for

Finding the best life insurance quotes for whole life policy is not just about finding the cheapest rate. It is about securing a reliable policy from a reputable provider that offers long-term value. There are some good qualities of the best whole life insurance providers, when you find them just buy the plan from that company.

- The provider has strong financial ratings.

- Transparent policy terms

- Customisable coverage.

- Good customer support and claims handling.

- Positive customer reviews.

Whole Life Insurance Policy Rates: What Affects The Cost?

The cost of whole life insurance policy depends on a few important things

First your age matters, it means that the younger people usually pay less for their insurance.

Your health also plays a big role if you have any health problem, you cost might be higher.

Gender can make a difference too, like women often pay less because they usually live longer.

The amount of coverage you choose will also affect the price. If you want a bigger payout for your family, your monthly cost will be higher.

Also if you had extra features or benefits to your policy these extra features are the writers then it can also make your policy cost more.

To get the best and most accurate quote, it is very important to always keep honest and complete information when filling out your insurance policy application form

Life insurance coverage options

Not every whole life insurance policy is the same.When you are looking for a plan, it is very important to choose one that fits your personal needs and goals. There are a few common types of coverage you can pick from. A standard whole life policy gives you a fixed monthly payment and a guaranteed payment when you pass away. A participating whole life policy may also give you extra money called dividends, depending on how well the insurance company is doing. With a limited pay whole life plan, you can only pay for a second number of years. Like 10 years 20 or 30 but the coverage lasts your whole life. A second premium whole life plan lets you pay just once, and then you are covered forever.

Some insurance companies also offer extra add-ons that are called riders, that give you more benefits. For example an accelerated that benefits that you use part of your pay out early if you get seriously ill. A long-term care writer helps pay for care if you can’t take care of yourself. A disability waiver of premium means you don’t have to pay your monthly cost if you become disabled.

Final thoughts

A whole life insurance policy is a great way to protect your money and take care of your family in the future. No matter if you are getting it for yourself or someone you love, it’s smart to take your time and compare life insurance quotes for whole life policy carefully.

Now thanks for the online tools, it is easier than ever to find affordable life insurance quotes for whole life policy. Just make sure to check what each policy offers, how much it costs, how trusted the company is and how useful the plan will be for you in the long run.

Get your free life insurance quotes for whole life policy today from M life insurance, it is quick, easy, and only takes a few minutes. Compare plans, check prices, and choose the coverage that fits your life in your budget.

FAQS

What are whole life insurance quotes?

The life insurance quotes for whole life policy is an estimated price that you have to pay for your insurance plan.

How can I get a life insurance quote for a whole life policy online?

You can visit the trusted in good insurance website, for that you have to fill out some basic information and get life insurance quotes for whole life policy in minutes

What factors affect whole life insurance policy rates?

Your age, health, gender, coverage mode and any extra benefits you add can affect your whole life insurance policy cost.

Our whole life insurance quotes more expenses than time life insurance?

Yes, whole life insurance usually costs more because it lasts your whole life and builds cash value over time.

How do I compare whole life insurance quotes from different providers?

Look at the price coverage amount policy features and companies reputation and the customer reviews to compare the price from different providers.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.