Key Points

- Expert legal claim help

- Handles denied policies

- Free first consultation

- State specific insurance laws

- Court and appeal support

- Fast and fair settlements

When a loved one passes away, life insurance can offer financial security to their family. But sometimes insurance companies delay, deny or dispute the valid claims. This will be solved by a life insurance lawyer or life insurance attorney who will help you. These noises work to make sure that the family gets the benefits they deserve.

No matter where you live in, which state you are in right now, there are so many experienced life insurance lawyers near you who can help you with this process. In this guide we will learn about the life insurance attorney and give you the complete guide to claim support.

What is a Life Insurance Attorney?

A life insurance attorney is a legal expert who will help the people with their problems that are related to the insurance claims. They can help you with these things like.

- Denied or delayed claims

- Disputes about who the beneficiary is

- Misunderstanding of the policy details

- Lapsed or expired policies

- Issues with power-of-attorney or trust credit to the life insurance

These lawyers know a lot about the insurance laws and they can talk directly to the insurance company to help and fix the problem quickly.

Why You Might Need a Life Insurance Attorney

Even if you have a valid life insurance policy, sometimes insurance companies will try to find the reason not to pay the benefits. A life insurance claim lawyer can help you with collecting the necessary documents, appeal denied claims, understand your policy terms, negotiate with the insurance company and file a lawsuit if needed.

Hi, the best life insurance lawyer mean that you will have someone who is looking out for your rights and handing all the complicated legal paper works for you.

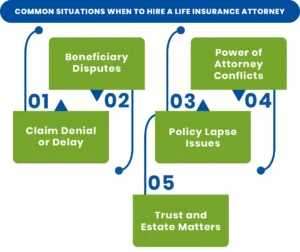

Common Situations When to Hire a Life Insurance Attorney

Claim Denial or Delay

Sometimes the insurance companies deny or delay the payment because of small mistakes or misunderstandings. For example, if the insured person missed one payment, the company might refuse to pay the full benefit. A lawyer can help challenge this decision.

Beneficiary Disputes

If more than one person says that they are the rightful beneficiary, a lawyer can help to settle the method legally and make sure that the right person receives the money.

Policy Lapse Issues

If your policy was cancelled or lapsed, but you believe it was not your fault then a lawyer can help you to prove your case and fight for your benefits.

Power of Attorney Conflicts

A power of eternal life insurance lawyer will help when someone misuses their power or makes unauthorised decision about life insurance policy

Trust and Estate Matters

And an irrevocable life insurance trust lawyer will make sure that the insurance money is given out according to the disease wishes and trust documents.

Life Insurance Attorneys Near Me

It is very important to find a trusted life insurance lawyer near you, especially during the difficult times. There are so many law firms that offer a free consultation so that they can understand your situation before taking your case.

1. Life Insurance Claim Attorney Baton Rouge

Lawyers in Baton Rouge deal with the local and state insurance issues they will help with delayed or denied claims under Louisiana’s insurance laws.

2. Life Insurance Claim Attorney Houston

If you are in Texas, a lawyer in Houston can help you to file your claim, appeal a denial or even represent you in court if there is any need

3. Life Insurance Claim Attorney New Orleans

In New Orleans, there are skilled lawyers who understand how state law and insurance policies work together. They can help you to get your benefits even in the most complex cases.

4. Life Insurance Attorney Florida

Florida lawyers will handle both individual and group life insurance claims. There are so many of them who are free consultations and only charge a fee if you win the case.

5. Life Insurance Attorney California

In California, life insurance lawyers can help with both small and large plain disputes. No matter if you are in Los Angeles, San Francisco or San Diego they have experience dealing with the major insurance companies.

How Much Does Life Isurance Cost?

Services Provided by Life Insurance Attorneys

Free Consultation

There are so many law firms who are offering the free first meeting to review your case. You can share your situation and the lawyer will guide you on the next steps.

Policy Review

Life insurance policies can be hard to understand. Lawyers carefully read and explain your policy so you know your rights and benefits.

Claim Filing And Appeal

A lawyer will help you to prepare all the documents, collect the proofs and submit your claim correctly. If your claim is denied, they can also handle the appeal to get it reconsidered.

Court Representation

If things go to the court, your life insurance lawyer will represent you and fight for your benefits

Negotiation And Settlement

Most of the cases are solved through negotiation. Your lawyer will make sure that you get affair payment without a long delay.

How Much Does a Life Insurance Lawyer Cost?

The cost of the life insurance lawyer depends on your case and where you are living. It is a simple idea of what you can expect from hiring a life insurance lawyer.

Free consultation

Most of the lawyers offered the first meeting for free so you can discuss your case without paying anything

Contingency fee basis

Many lawyers only charge a percentage usually 30% to 40% if you win the case. If you don’t win, you don’t have to pay.

Hourly rate or flat fee

Some lawyers are charged by the hour or the fixed amount, specially for the simple cases.

How to Choose the Best Life Insurance Attorney

When you’re looking for the best life insurance lawyer, you have to keep these points in mind

- Choose a lawyer who has handled the similar cases successfully and he has the experience

- Re-testimonials and online review reviews to see what other clients say about the lawyer

- Pick someone who explains things very clearly and keeps you updated

- Make sure that the lawyer has enough time to focus on your case

- A local lawyer understands state insurance law better than and can help you faster than the outside lawyer.

What Are the 4 Types of Life Insurance?

Understanding and knowing the types of life insurance policy can help you to make the better choices

- Term life insurance will cover you for a certain number of time like 10, 20 or 30 years

- Whole life insurance gives you lifetime coverage and also include a saving feature that will grow overtime

- Universal life insurance offer you the flexible payment and investment options

- Variable life insurance combines the life insurance with investment opportunities so that your benefit can grow depending on the market performance.

How Do I Fight a Life Insurance Policy?

If your life insurance claim get denied, you don’t have to worry about it here here is what you should do

Ask for the Denial Letter

The letter will tell you why your claim was rejected

Collect Important Papers

You have to get all the medical records, payment proofs in the messages or emails from the insurance company

Talk to a Life Insurance Lawyer

A lawyer can check your case and apply the decision for you

File a Complaint or Case

If the company still refuses to pay, your lawyer can take legal action in court.

Power of Attorney and Life Insurance

A power of attorney (POA) gives someone the right to make decisions for another person. A power of attorney life insurance lawyer makes sure that the person with this power uses it correctly and doesn’t misuse it.

If someone commits fraud or makes an unauthorized claim, your lawyer can take legal action and challenge it in court.

Conclusion

Satisfy you can make a big difference when you face the delayed, denied or disputed claims. They take care of all the paperwork, communicate with the insurance company and protect your rights so you can focus on your family and healing.

Protect your family’s future today.

Get the right life insurance plan that gives you peace of mind. Get a Free Life Insurance Quote from M-life Insurance.

FAQS

Most life insurance lawyers don’t ask for money at the start. They usually work on a no-win no fee basis which means that you only pay them if they help you to win your case. Sam also offered a free first meeting to check your situation.

An insurance attorney is a lawyer who helps people when they have problems with insurance companies. They make sure the company pays what it promised in the policy and help you if your claim is denied or delayed.

There are four main types of life insurance that are term life insurance, whole life insurance, universal life insurance and variable life insurance.

If your claim is denied, you can find it by asking the company for a denial letter to know the reason, collecting all the papers, receipts and medical records and talking to the life insurance attorney who can appeal the legal action for you.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.