Key Highlights

- Trusted retirement annuity providers

- Strong customer service support

- Easy online account access

- Financially stable and reliable

When it comes to securing your financial future, choosing the right life insurance and annuity provider is very important. Jackson National Life Insurance company that is also known as Jackson. It has been a leading name in the United States insurance and retirement industry for so many years. The company is known for its strong and annuity products, reliable customer service, and flexible retirement solutions. Jackson has built a very strong reputation among the financial professionals and policy holders.

In this detailed article we will cover everything you need to know about the Jackson National Life Insurance company including its products, services, conduct information and reviews. We will cover all these things in simple and easy to understand words.

About Jackson National Life Insurance

Jackson National Life Insurance company was founded in 1961 in Lansing Michigan. The company is a subsidiary of Prudential Plc, which is a major international financial services group based in the United Kingdom. Jackson has grown into one of the largest providers of retirement and annuity products in the United States.

The main focus of the company is to help the American to plan for retirement income, manage investment and protect their families financially. Jackson’s products are specially designed for the people who are looking for long-term security and financial stability.

What Happened To Jackson National Life Insurance Company?

There are so many people who ask what happened to Jackson’s national life? The answer is very simple that Jackson did not disappear or shut down their company. Instead the company stopped sending me life insurance policies to concentrate freely on the annuity and retirement products.

This change will allow Jackson to focus on what it does best, providing retirement income solutions and helping the customer to manage the financial risk in their later years.

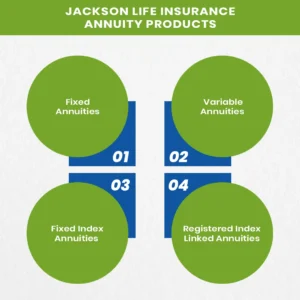

Jackson Life Insurance Annuity Products

Jacksons offers a wide variety of annuity products that are special to decide to meet the different retirement needs and goals let’s have an overview

Fixed Annuities

Fixed annuities provide the guaranteed income with the set interest rate for the specific time period. They are the best for the people who prefer low risk investments and stable returns.

Variable Annuities

Variable annuities can allow the investors to allocate the funds into different accounts that is similar to mutual funds, which means that returns vary based on the market performance. They offer growth potential but come with market risks.

Fixed Index Annuities

These annuities are linked with the stock market in index like S&P 500 but these provide protection against losses. You get the potential growth without risking your principal amount.

Registered Index-Linked Annuities

RILAs combine market participation with downside prediction. They allow the partial exposure to the market gains by limiting the potential losses.

Jackson Life Insurance Company Customer Service

Customer service plays a very important role in Jackson’s reputation. The company provides so many support channels for the customer like you can call on their number, there are so many numbers that are provided on the Jackson life insurance company website so you can get the phone number from there and then call for your related problem. Their customer service is open from Monday to Friday 8 am to 8 pm so that you can call in between this time.

Jackson National Life Insurance Company Reviews

Jackson’s national life insurance generally receive a positive review for its annuity products, financial strength and the customer service

Here are some pros and cons so you can understand better after reading

Good points

- Strong financial ratings by A by AM best

- Diverse range of annuity options

- Accident online account access

- Long history and trusted brand

Areas to Improve

Limited life insurance offerings

How Much Does Life Isurance Cost?

Complex annuity features of beginners.

Jackson Life Insurance Claims And Support

Filing a claim with Jackson is very easy and straightforward. Policyholders or the beneficiaries can contact the claims department directly to the tax and insurance phone number or by submitting the forms

Here are the steps to file a claim

- Contact Jacksons customer support or visit their website

- Provide the policy details and supporting documents

- Then wait for the claim to review and processing

Can You Pay Jackson National Life Insurance Online?

Yes you can pay, Jacksons allow the customer to make the payments online through a secure online portal. To pay online you have to visit www.jackson.com and then you have to log into your account using your policy or annuity details and final choose your payment method like bank transfer debit or credit and then your payment will be done

When Did Jackson National Life Stop Selling Life Insurance

Injection spot selling new life insurance policies around 2012 to 2013. This is just because they want to focus entirely on the retirement and annuity products. Existing life insurance policies will remain supported and can still manage their policies to the companies customer service or online portal.

Jackson National Retirement Services

Jackson National also provides the retirement planning services under its Jackson national retirement services division. These services help employers and individuals to manage the 401K plans, IRA rollovers, retirement and income planning and investment management.

Jackson Life Insurance Career And Employment Opportunities

Jackson offered so many reporting careers opportunities to cross the multiple areas, they offer in the finance and technology to customer service and marketing.

Pay the competitive pay and the benefit they also have inclusive workplace culture, opportunities for growth, hybrid and remote roles

Is Jackson National Life A good company

Yes, Jackson National insurance company is considered as the best and financially strong organisation. This will hold high financial ratings, strong industry experience and millions of satisfied customers. The company focuses on the innovation, customer support and long-term financial security that will make it a trusted choice for the retirement plan.

Jackson Life Insurance Company New York Division

Jackson national life insurance company of New York operates as a separate entity to comply with the state specific regulations. It provides annuity and retirement products to the residents of New York state. This division maintains the same financial stability and protects quality as the main jackson brand.

Final Thoughts

National life insurance company continues to be one of the most respected names in the United States retirement industry the company comes with so many benefits with clear and focused annuities , customer satisfaction and financial strength. No matter if you are planning for your future income or you are looking for the trusted annuity provider.

Looking for a reliable life insurance or retirement plan? M-life Insurance helps you find trusted providers like Jackson National. Get your free quote today and start planning your secure future!

FAQS

Jackson life insurance is a company that helps people save money for retirement. They sell the products that are called annuities which give you the income after you retire. The company started in 1961 and it is based in Michigan.

Yes, jackson life is known as a good and trusted company. It has been in business for so many years and it has strong financial ratings. It means that it is safe and reliable. There are so many customers who are happy with your services and annuity plans.

Yes, you can easily pay online. You just need to go to their website and log into your account. There you can make the payments, check your balance and update your information any time whenever you want.

Just stop selling new life insurance policies in the year 2012 to 2013. Now the company is mainly focusing on retirement and annuity products. If you already had a policy before that time it is still active and supported.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.