Key Points

- Lifetime coverage guarantee

- Fixed premium stability

- Builds cash value

- Better early rates

- Strong long term protection

Most people think that choosing a life insurance policy is very complicated, but what if it did not have to be? Whole life insurance is one of those topics everyone hears about, yet few truly understand. There are so many options but whole life insurance stands out as one of the most talked about choices, promising lifetime coverage, guaranteed savings and long-term stability. But is it really worth the higher cost?

In this complete 2025 guide we will break down everything about the whole life insurance policy clearly, simply and without the confusing insurance jargon. So that you can finally decide whether the whole life insurance is a smart move for your future or not.

Whole Life Insurance Plans – Simple Understanding

A whole life insurance policy is a type of permanent life insurance that provides the coverage for your entire lifetime, not just a set number of years. The plan also includes the cash value feature that grows over time.

In simple terms, it’s a lifetime policy with guaranteed payout, fixed premiums and a saving component that grows tax deferred.

This combination of lifelong protection plus guaranteed saving is the main thing that makes whole life insurance different from other insurance policies.

How Does Whole Life Insurance Really Works

Here is a very simple breakdown for whole life insurance that how it will work for you

- First, you have to pay a fixed premium every month or year

- Then a portion goes towards the death benefit

- Another portion goes into the cash value, which grows at the guaranteed interest rate

- You can borrow or withdraw from cash value later in life

- Your family will get a guaranteed payout when you pass away

Is Whole Life Insurance Worth It?

Whole life insurance is a great pick if you want coverage that never expires, payments that never change, and cash value that grows quietly in the background. But if you are looking for something cheap, shorter or more flexible than whole life insurance probably is not your match.

Think of whole life insurance as a lifelong commitment, so that it’s amazing for the right person and unnecessary for others.

Difference Between Term And Whole Life Insurance

Understanding the difference between term life insurance and whole life insurance is very important before you make your choice. Let’s have a look at both the policies insights so that you can understand better.

Term Life Insurance

Term Life insurance is the temporary coverage option that just lasts for a set number of years. You can choose that term like 10 years, 20 or 30 years. There is no cash value in this plan. It is much cheaper than the whole life insurance. This plan is known for its simple coverage that focused on income replacement.

Whole Life Insurance

Whole life insurance is that lifetime coverage option. This plan will cover you for life, and also builds cash value. This cash value grows over time and it is more expensive. The plan gives you guaranteed benefits and steady premiums.

Which One Is Better

If you want affordable and temporary protection, then term life insurance is the best pick for you.

- If you want lifetime coverage and cash value savings, then whole life insurance is the best option for you.

- Both the policies have the strong advantages, but it just depends on your personal financial goals

Universal Life Insurance vs Whole Life Insurance

There are so many people who compare universal life vs whole life. Because both are the permanent policies so it can be confusing for them to choose.

Whole Life Insurance

As you know that whole life gives you fixed premiums and also guaranteed cash value growth. It also has less flexibility but more predictability.

Universal Life Insurance

Universal life insurance also works as the permanent life insurance that also has the flexible premiums. But here is the difference that cash value depends on current interest rates. The policy has more control but more responsibility and cost can increase over time.

So universal life insurance is great for people who want flexibility while whole life is better for those who want stability and guarantees.

Variable Whole Life Insurance – Basic Understanding

Variable whole life insurance can be described as another type of permanent policy where the cash value is invested in sub accounts similar to mutual funds. This means higher growth potential, higher risk, guaranteed lifetime coverage and fluctuating cash value.

How Much Does Life Isurance Cost?

If you are comfortable with investing and market performance, then this can be a good option for you. If not, then the regular whole life insurance is a safer option.

Whole Life Insurance Rates by Age Chart

| Age | Male | Female |

| 25 | $150 – $190 | $130 – $170 |

| 35 | $210 – $270 | $180 – $240 |

| 45 | $320 – $420 | $280 – $370 |

| 55 | $520 – $680 | $450 – $590 |

| 65 | $830 – $1,100 | $720 – $950 |

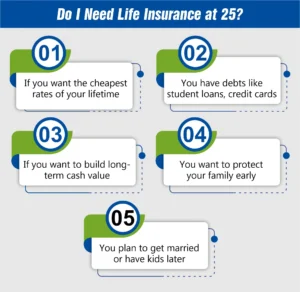

Do I Need Life Insurance at 25?

Many 25 year olds think they should get life insurance so early. Here is the truth that you should consider life insurance at 25

- If you want the cheapest rates of your lifetime

- You have debts like student loans, credit cards

- If you want to build long-term cash value

- You want to protect your family early

- You plan to get married or have kids later

How To Get The Lowest Rate Of Whole Life Insurance

To secure the lowest whole life insurance premium, you have to follow these steps

- Apply young age of 20s or early 30s

- Maintain good health

- Avoid tobacco and nicotine

- Choose the guaranteed level premiums

- Compare the multiple insurance companies

- Consider a medical exam policy for the better rates

Pros and Cons of Whole Life Insurance

| Pros | Cons |

| Lifetime coverage | More expensive than term insurance |

| Guaranteed cash value growth | Long-term commitment |

| Fixed premiums | Cash value grows slowly in early years |

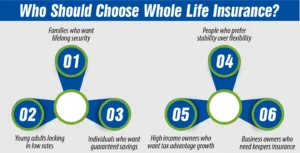

Who Should Choose Whole Life Insurance?

Whole life insurance is best for these

- Families who want lifelong security

- Young adults locking in low rates

- Individuals who want guaranteed savings

- People who prefer stability over flexibility

- High income owners who want tax advantage growth

- Business owners who need keepers insurance

Who Should Avoid Whole Life Insurance?

Whole life is not best if your budget is tight, and you only need the temporary coverage. It is also not best for the people who prefer flexible premiums and want the cheapest option available. In these cases term or universal life can be a better option.

Final Thoughts

Yes, whole life insurance is worth it for the people who want lifetime protection, guaranteed savings, fixed premiums and long-term peace of mind. The policy can cost more, but it offers benefits no other insurance type can match. When this plan is compared to term life insurance or universal life insurance, the whole life stands out for its stability and guaranteed growth. No matter what age you want to buy but make sure that you buy in your 20s or early 30s so that whole life insurance can be a smart investment in your future and your family financial security.

Lets choose M-Life Insurance and get lifetime protection, guaranteed growth, and a plan designed around your financial goals.

FAQS

The downside is that whole life insurance is more expensive than term life insurance. It also includes cash value slowly in the beginning and requires long-term commitment to get full benefits.

The catch is the high cost. You pay much more than term life insurance because it lasts for life. It also builds cash value, if you cancel early then you may lose money.

The main advantage is lifetime protection. It also guarantees cash value growth, fixed premiums and tax advantage savings features, making it a stable financial tool for long-term security.

A $500,000 whole life policy usually costs $250-$800 per month depending on your age, health, and insurance company. Younger people pay much less because they lock in lower lifetime rates early.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.