Key Points

- The individual health insurance plans are offering flexible, personal coverage

- PPO plans provide the maximum provider freedom

- Affordable options are there for all income levels

- Cost depends on age, location, and the plan type

- Family plans, cover the dependants under the one policy

- State specific plans, vary in benefits and pricing

- Supplemental plans are there to reduce out-of-pocket costs.

Healthcare costs continue to rise, and this is the main thing that makes the individual health insurance plan more important than ever. If you are thinking about it, whether self-employed, freelancer, and unemployed, or simply you are not covered by any employer, we are here and provide the right insurance Individual plan so that you can protect both your health and your finances.

The guide will explain everything you need to know about health insurance plans for single people. You can also find the types of coverage, cost, and how to choose the best plan for your needs.

Individual Health Insurance Plans

Individual health insurance plans are policies that are purchased directly by the individuals or the families and not through any employer or group program. All these plans are specially designed to provide the important medical coverage such as doctor visits, hospital care, and the preventive services.

This is not like the group plans, health insurance individual plans are offering flexibility, also allow you to select the coverage levels, provider network, and the premiums that suit your lifestyle and budget.

Who Needs Health Insurance Plans for Individuals

You can need the health insurance plans for the individuals if you are one of these

- Self-employed or a freelancer

- A small business owner without the employee benefits

- Between jobs or newly unemployed

- A student or the recent graduate

- Retired but not yet eligible for any Medicare

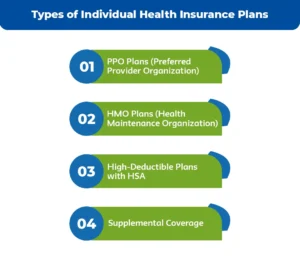

Types of Individual Health Insurance Plans

Let’s have a look at the types of individual health insurance plans. Understanding the plan times will help you to make the best decision.

PPO Plans (Preferred Provider Organization)

Individual PPO health insurance plans are offering the maximum flexibility. You can visit the doctors without referrals and use out of network providers at the higher cost. All these plans are best for the people who value choice.

HMO Plans (Health Maintenance Organization)

HMOs usually have the lower premiums but can require using in network doctors and referrals. They are often included in the cheap health insurance plan for individuals.

High-Deductible Plans with HSA

The individual HSA health insurance plans combine the lower monthly premiums with tax advantage savings accounts. All these plans are excellent for healthy individuals who want long-term savings

Supplemental Coverage

Supplemental health insurance plans for individuals will help to cover the expenses like deductibles, co-pays, or the specific service that are not fully paid by the primary insurance.

Individual and Family Health Insurance Plans

If you are covering the dependents, individual and the family health insurance plans bundle the coverage under one policy. These plans typically offer maternity care, pediatric services, and preventive care for children. Families most of the time benefit from broader coverage options and the cost benefits when choosing a single plan.

Affordable and Inexpensive Health Insurance Options

Affordable Individual Health Insurance Plans

The affordable individual health insurance plans balance, the monthly premiums, also the deductibles and out-of-pocket costs. There are so many people who qualify for subsidies, depending on their income.

Inexpensive & Cheap Health Insurance Plans for Individuals

Inexpensive health insurance plans for individuals often have higher deductibles but lower monthly payments. These plans worked well for the people who don’t visit the doctors frequently.

Let’s have a look at some of the key ways to reduce the cost

- Choose a higher deductibles

- Use in network providers

- Compare the plans annually

- Consider the HSA compatible plans

How Much Do Individual Health Insurance Plans Cost?

This is one of the most common questions that people ask. The simple answer is that the cost is never fixed, and it depends on your age, location, coverage level, tobacco use, and the plant type.

Talking about on average basic plans may start from low monthly premiums. The comprehensive PPO plans cost more but offer wider access and the family plans cost more than the individual coverage. Choosing the right balance between premium and the coverage is very important.

How Much Does Life Isurance Cost?

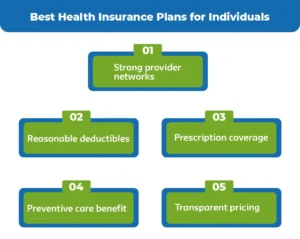

Best Health Insurance Plans for Individuals

The best individual health insurance plans are those that meet your medical and financial needs. You just have to look for the plans that offer you these things.

- Strong provider networks

- Reasonable deductibles

- Prescription coverage

- Preventive care benefit

- Transparent pricing

For all the people who want flexibility, the best health insurance plan for individuals mostly includes PPP rescription O options and comprehensive coverage.

State-Specific Individual Health Insurance Plans

If you are looking for the state specific individual health insurance plan then let’s have a look at eat for the better understanding

Best Florida Health Insurance Plans for Individuals

Florida residents preferred the PPO plans because of broad networks and specialist access. The coverage options can be different by the country so comparing the providers is very important.

Individual Health Insurance Plans California

California offers the large marketplace options with preventive care, benefits, and subsidy opportunities. There are so many plans that emphasize affordability and wellness.

Individual Health Insurance Plans Texas

Texas residents can choose from a wide range of health insurance plans into individual issues with flexible provider networks, and the best pricing.

Private Health Insurance Plans for Individuals

A private health insurance plan for single people is outside the government programs. These plans are most of the time providing fast access to specialists, there is more customization and wider coverage options. All these plans are popular among the self-employed professionals and the high income earners.

How to Choose the Right Individual Health Insurance Plan

When you are selecting a health insurance individual plan you have to consider the following things. And also compare multiple individual health plans to make sure that you find the most cost-effective options.

- your medical needs

- Monthly premiums vs deductibles

- Preferred doctors and hospitals

- Prescription drug requirements

- Travel are out of state coverage

Benefits of Individual Health Insurance Plans

At last, let’s have a look at the benefits of individual health insurance plans that how this plan can benefit you

- Financial protection for medical emergencies

- Access to preventive care

- Coverage that are specially designed to your needs

- Flexibility in provider choice

- Peace of mind for individuals and families

Final Words

Choosing the right individual health insurance plan is one of the most important financial decisions you can ever make. With options that range from health insurance plans for the individual to the comprehensive PPO coverage, there’s a plan for every lifestyle and budget.

You just have to compare the benefits, understanding the cost of the plan and selecting the coverage that fits your needs and budget. You can secure the arrival, healthcare protection for yourself and your family.

Protect your health and finances today with M-life insurance plans. You can get the affordable coverage, expert guidance and personalized support you can trust.

FAQS

Health insurance for one person usually cost a few hundred dollars per month, and it depends on the age, location, and the coverage level

The best person health insurance is one that fits your budget, covers your doctors and includes the medical services you need most.

The best private healthcare plan offered the good doctor networks, there are fair costs, prescription coverage, and flexible options like PPO plans.

The four main types are HMO, PPO, EPO and POS health insurance plans.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.