Health insurance is essential for protecting yourself from unexpected medical expenses. For people who do not receive coverage through an employer, individual health insurance offers a reliable way to access quality healthcare. It provides financial security while allowing individuals to choose plans that fit their medical needs and budget.

This guide explains what individual health insurance is, how it works, average costs, coverage options, and how to choose the best plan with help from M Life Insurance.

What Is Individual Health Insurance?

Definition of Individual Health Insurance

Individual health insurance is a policy purchased by a single person rather than through an employer or group plan. It covers medical services such as doctor visits, hospital care, prescriptions, and preventive services. These plans are designed to meet personal healthcare needs. They give individuals full control over their coverage choices.

Who Should Buy Individual Health Insurance

This type of insurance is ideal for self-employed individuals, freelancers, early retirees, students, and people between jobs. It is also useful for those whose employers do not offer health benefits. Individual coverage ensures continuous access to medical care. It also protects against high out-of-pocket expenses.

Individual vs Family Health Insurance

Individual plans cover only one person, while family plans include multiple members under one policy. Individual insurance is usually more affordable for single people. Family plans may offer broader coverage but come at a higher cost. Choosing the right option depends on household size and healthcare needs.

Why Individual Coverage Matters

Without insurance, medical emergencies can become financially overwhelming. Individual health insurance provides peace of mind and access to preventive care. It helps individuals manage healthcare costs effectively. Long-term coverage also supports better overall health outcomes.

How Individual Health Insurance Works

Monthly Premiums

A monthly premium is the amount paid to keep the policy active. Premiums vary based on age, location, plan type, and coverage level. Younger and healthier individuals usually pay lower premiums. Consistent payments ensure uninterrupted coverage.

Deductibles and Cost Sharing

Most plans include a deductible that must be met before full coverage begins. After that, copayments and coinsurance apply to medical services. These costs vary by plan. Understanding them helps avoid unexpected expenses.

Out-of-Pocket Maximums

Individual health insurance plans include an annual out-of-pocket limit. Once this limit is reached, the insurer covers most eligible medical costs. This feature protects individuals from excessive healthcare expenses. It adds financial security during major medical events.

Provider Networks

Insurance plans work within specific networks of doctors and hospitals. Using in-network providers lowers healthcare costs. Out-of-network care may cost more. Always check network availability before choosing a plan.

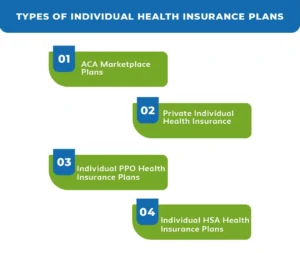

Types of Individual Health Insurance Plans

ACA Marketplace Plans

ACA plans offer essential health benefits and cover pre-existing conditions. They are available through federal or state marketplaces. Many individuals qualify for income-based subsidies. These plans provide comprehensive and regulated coverage.

Private Individual Health Insurance

Private plans are purchased directly from insurance companies or brokers. They may offer flexible coverage options and wider provider networks. These plans suit individuals who do not qualify for subsidies. M Life Insurance helps compare private options easily.

Individual PPO Health Insurance Plans

PPO plans allow individuals to see specialists without referrals. They offer both in-network and out-of-network coverage. PPOs provide greater flexibility but usually have higher premiums. They are ideal for people who value provider choice.

Individual HSA Health Insurance Plans

HSA plans pair high-deductible insurance with a tax-advantaged savings account. Funds can be used for qualified medical expenses. Unused money rolls over each year. These plans work well for healthy individuals seeking long-term savings.

Cost of Individual Health Insurance

Average Monthly Cost

The average cost of individual health insurance varies by age and location. Many individuals pay a few hundred dollars per month. Subsidies can significantly reduce costs for eligible applicants. Comparing plans helps find affordable options.

Factors That Affect Pricing

Age, tobacco use, plan type, and coverage level influence insurance costs. Geographic location also plays a major role. PPO plans usually cost more than HMO plans. Understanding these factors helps in budgeting.

Affordable Individual Health Insurance Options

Affordable plans often include higher deductibles but lower premiums. Bronze and Silver plans are popular cost-effective choices. Preventive services are typically covered. These options balance affordability and essential coverage.

How Much Does Life Isurance Cost?

Cheap Individual Health Insurance Plans

Low-cost plans provide basic protection against emergencies. They may have limited benefits and higher deductibles. Cheap plans suit healthy individuals with minimal medical needs. Always review coverage details carefully.

Best Individual Health Insurance Plans

Evaluating Coverage Needs

Choosing the best plan depends on healthcare usage and prescription needs. Frequent doctor visits may require comprehensive coverage. Minimal usage may suit lower-cost plans. Assessing needs ensures the right balance.

Comparing Plan Benefits

Compare premiums, deductibles, and out-of-pocket limits. Network size and prescription coverage are also important. Small differences can impact long-term costs. Detailed comparisons lead to better decisions.

Choosing Reliable Insurance Companies

Reputation and customer service matter when selecting insurers. Reliable companies offer smoother claims processing. Strong support improves the overall experience. Trustworthy guidance simplifies enrollment.

Role of Individual Health Insurance Agents

Agents help individuals understand complex plan options. They assist with comparisons and enrollment. M Life Insurance provides expert support tailored to individual needs. Professional guidance saves time and money.

Individual Health Insurance by State

Individual Health Insurance in California

California offers a wide range of ACA and private plans. State regulations provide strong consumer protections. Subsidies are available for qualifying individuals. Plan options vary by region.

Individual Health Insurance in Florida

Florida residents can choose from multiple insurers. Costs vary based on location and age. Private and marketplace plans are available. Network coverage should be reviewed carefully.

State-Specific Plan Availability

Each state has unique insurance rules and options. Provider networks differ by region. Understanding local regulations helps in choosing suitable coverage. State-based research is essential.

Why Location Matters

Healthcare costs and insurer participation vary by state. This impacts pricing and plan availability. Always compare plans within your state. Local knowledge leads to better choices.

How to Buy Individual Health Insurance

Online Marketplaces and Private Insurers

Individuals can purchase insurance through ACA marketplaces or private insurers. Online tools simplify comparisons. Enrollment periods apply to most plans. Timely action is important.

Getting Individual Health Insurance Quotes

Quotes help estimate monthly premiums and coverage costs. Comparing multiple quotes reveals better deals. Accurate information ensures realistic pricing. Quotes guide informed decisions.

When to Enroll

Open enrollment is the primary period to buy coverage. Special enrollment applies after life events. Missing deadlines can delay coverage. Planning ahead avoids gaps.

Assistance from M Life Insurance

M Life Insurance helps individuals find and compare the best health insurance options. Expert guidance simplifies the process. Personalized support ensures confident decisions. Reliable advice makes coverage selection easier.

Conclusion

Individual health insurance provides essential protection for people without employer-sponsored coverage. With options ranging from ACA marketplace plans to private PPO and HSA plans, individuals can choose coverage that fits their healthcare needs and budget.

By understanding costs, plan types, and state-specific options, individuals can make informed decisions. With expert support from M Life Insurance, securing the right individual health insurance becomes simple and stress-free.

FAQS

It is a health insurance plan purchased by an individual rather than through an employer.

Monthly costs typically range from a few hundred dollars depending on age, location, and coverage.

The best plan depends on medical needs, budget, and preferred providers.

Plans with balanced premiums, strong networks, and comprehensive benefits are often best.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.