Key Points To Remember

- Guaranteed issue Whole Life Insurance requires no medical exam

- Policies provide lifelong coverage and fixed premiums

- Coverage is best for seniors or high risk applicants

- Major carriers include AA, AIG, MetLife, Mutual of Omaha and New York life

- Difference between Guaranteed issue and graded benefit is mainly payout timing

- Weights can be changed on the basis of your age, coverage, and carrier

- Policies often include cash value and final expense coverage

Imagine life insurance that says yes, no matter what your age or what health condition you have. Like a very simple thing no questions no exams just Guaranteed peace of mind for you and your family. That is exactly what the Guaranteed issue whole life insurance policy offers. No matter if you are planning for the final expenses, you want to leave a legacy or simply you want to secure your loved ones so they will be protected, this plan makes everything very simple. In a world full of maybe approvals and complicated medical hoops, Guaranteed life insurance is a rare promise of coverage that’s Guaranteed just for you. And in this detailed guide we will learn how this life insurance will give you benefits, how it works and how you can get the best plan to secure your family so let’s get started.

Unlocking Peace Of Mind – What Is Guaranteed Issue Whole Life Insurance

Guaranteed issue Whole Life Insurance is the type of permanent type insurance policy that guarantees his approval without any health cost or medical exam. This insurance will make sure that even higher risk can secure coverage. These policies can cover the funeral costs, final expenses, and they can provide a financial safety net for your loved ones.

Guaranteed issue vs graded benefit whole life differs mainly in payout structure. File Guaranteed issue pays the full benefit immediately in most cases while the benefit plan can limit the initial payout if the insured person dies within the first few years.

How Guaranteed Issue Whole Life Insurance Really Works

Guaranteed issue policies are very straightforward like

- The approval is Guaranteed regardless of any health condition that there is no medical exam required

- You get the fixed premiums and they remain constant overtime

- The coverage last for your entire life and it never expires like the term life insurance

- The plan also provides a payout to beneficiaries upon death, that is often used for the final expenses

Guaranteed issue Whole Life Insurance quotes are higher than traditional life insurance because there is no exam and due to this benefit it charges more. However, the peace of mind that comes with Guaranteed coverage often outweighs the cost.

Top Players: Best Guaranteed Issue Whole Life Insurance Companies

There are several reputable providers who are offering Guaranteed issue Whole Life Insurance policies. Here are some of the leading providers that provide the best coverage to the families.

AAA Guaranteed Issue Whole Life Insurance

These plans come with affordable Guaranteed issue whole life insurance rates and flexible coverage options.

AIG Guaranteed Issue Whole Life Insurance

This plan offers coverage up to $25,000 with simplified application process

Mutual Of Omaha Guaranteed Issue Whole Life Insurance

Mutual of Omaha offers a strong track record and financial stability.

New York Life Guaranteed Issue Whole Life Insurance

They gave the best plans and it is one of the oldest insurance companies that is providing reliable policies.

MetLife Guaranteed Issue Whole Life Insurance

MetLife Guaranteed issue Whole Life Insurance offers competitive premiums, and they also give customizable coverage options.

Coverage That Counts: Benefits of Guaranteed Issue Policies

The current issue of Whole Life Insurance policies offers so many benefits. Let’s have a look at each better at

- The plan keeps final expense coverage that will help to cover the funeral, barrier or cremation costs.

- It also provides fixed premiums that the payments will remain the same for the duration of policy

- The plan also comes with immediate peace of mind that the coverage is getting indeed, regardless of any health issue

- There are some of the policies that cash value that you can borrow against whenever you needed

- Applications are reasonable with minimal paperwork like there is no medical exam for the plans

Head-to-Head: Guaranteed Issue vs Graded Benefit Whole Life Insurance

Understanding the difference between Guaranteed issue Vs graded benefit Whole Life Insurance is very important

Guaranteed Issue

This plan pays the full death benefit immediately regardless of any cause of death

Graded Benefit

Graded benefits pay a limited benefit if that occurs within the first two or three years. The full death benefit is only paid after the graded period.

Graded benefit plans often have slightly lower premiums as compared with Guaranteed issue policies. However, the initial limited payout can be a disadvantage for the people who are looking for immediate full coverage.

Breaking Down the Costs: Understanding Rates and Premiums

Guaranteed Issue Whole Life Insurance rates can be changed according to your age at the time of application, your gender, coverage amount, and insurance provider.

For example, a 60 year old can have to pay between $50-$150 per month for a $10,000 policy. While rates can be higher than the traditional life insurance, the Guaranteed approval and life coverage make it a worthwhile investment for those who have health issues or advanced age. Just remember to compare the multiple Guaranteed issue whole life insurance quotes to make sure that you find the best premium for your desired coverage.

How Much Does Life Isurance Cost?

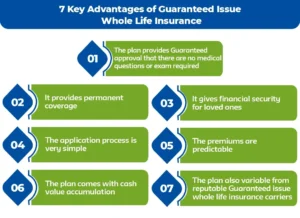

7 Key Advantages of Guaranteed Issue Whole Life Insurance

You are supposed to major benefits of guarantee, issue or life insurance

- The plan provides Guaranteed approval that there are no medical questions or exam required

- It provides permanent coverage

- It gives financial security for loved ones

- The application process is very simple

- The premiums are predictable

- The plan comes with cash value accumulation

- The plan also variable from reputable Guaranteed issue whole life insurance carriers

Picking Your Perfect Policy: How to Choose Wisely

Whenever you are selecting a Guaranteed issue life is you have to consider these factors to get the better plan

- Determine the coverage amount needed to cover the final expenses

- Make sure the monthly payments fit your budget

- Financially stable companies with good customer services

- Check for the cash value options, riders or additional benefits

It is advisable that you have to speak with an insurance agent through online tools to get multiple Guaranteed issue Whole Life Insurance quotes. Comparing the providers like AAA, AIG, MetLife and Mutual of Omaha will help you a lot to find the best plan for your needs.

Senior-Friendly Tips: Getting the Most Out of Your Policy

Seniors often benefit the most from Guaranteed issue policies because health issues can prevent them from qualifying for the traditional insurance plans, lifelong coverage will make sure that final expenses are covered and policies are easy to understand and manage.

Always review your policy documents and make sure that your beneficiaries are up-to-date. This will make sure that our payout will be smooth when the time comes.

Simple Steps: How to Apply and Get Approved Fast

Applying for Guaranteed life insurance is very simple. You just have to choose a carrier, select the coverage amount, complete the application form, review your policy and confirm the premiums and once you have done this, then you start paying monthly premiums after approval.

Final Thoughts: Why Guaranteed Issue Whole Life Insurance Is Worth It

Guaranteedissue Whole Life Insurance is an excellent choice for anyone who cannot qualify for the traditional life insurance due to their age or any of their health conditions. By understanding the differences between the Guaranteed issue and other plans, comparing the Guaranteed issue whole life insurance quotes and selecting the reputable carrier, you can secure lifelong protection for yourself and financial security for your loved ones.

Always make sure to compare the prices, compare the providers and make the best decision that is going to be best for you and your family.

Get Your Free Quote Today

Secure peace of mind for your family. Get your Guaranteed Whole Life Insurance quote today from M-life Insurance.

FAQS

Guaranteed issue means that you can get insurance no matter what your health is. You don’t need a medical exam or health questions. If you apply then the Guaranteed issue whole life insurance companies has to approve you.

The three main types are traditional Whole Life Insurance , graded benefit Whole Life Insurance , and Guaranteed issue for life insurance.

Most of these things are guaranteed like the death benefit and fixed premiums. But investment quotes or extra benefits are not guaranteed.

The death benefit and the fixed premiums are guaranteed by Whole Life Insurance .

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.