Last Updated on: October 17th, 2025

- Licensed Agent

- - @M-LifeInsurance

Key takeaways

- Globe Life offers term, whole, and accidental insurance options.

- Online login and bills pay makes management simple.

- Rates for senior start around $60 per month.

- It’s a legitimate company with an A rating.

- Customer service reviews and mixed but improvement.

Choosing the right life insurance policy is not it especially when there are so many companies offering the same plans but globe life insurance is one of the most recognised and a well-known name in the insurance market globe life insurance is known for as easy application process with no medical exam policies but is globe life insurance good for you or bad? Lets explore its features, benefits, customer feedback and pricing in simple words.

About Globe Life And Accident Insurance Company

Globe life and accident insurance companies are part of a well-known globe life group. This company has been offering insurance in the United States for so many years the company also provides low-cost life and accident insurance plans that will come for both individuals and families.

People like globe life because this is easy to apply. Also the coverage options are very simple and you can choose how you want to pay. You can also use the globe life insurance login portal to check your policy. See your coverage details and pay your bills online. This will make it convenient for anyone who prefers managing their insurance without paperwork.

Globe Life Insurance Login And Bill Pay

Globe life has a simple online portal that will make and manage insurance easily. You can login using your policy number, your name and date of birth. After logging in you can see the following things.

- You see your globe life insurance policy details

- Pay your premiums and manage payments

- Download your policy documents

- Update your address or contact information

- Add or change your beneficiaries

Bill Payment Options

Globe life makes it easy to pay your insurance premium in so many different ways. Let’s have a look.

- Online bill pay : you can make payments directly on the globe life website

- Automatic payments: you can also set up auto pay so your premiums are paid on time and your policy never lapses

- Mail or phone payment: you can also send your payment by email or call club live’s customer service globe life insurance phone number to pay over the phone

Types Of Globe Life Insurance Policies

Global life offers of variety of insurance policies for different needs let’s have a look at the main types

Globe Life Term Life Insurance

Term life insurance policies gives you coverage for the number of years like 10, 15 or 20 years if the policyholder passes away during this time then the family or loved ones will receive a death benefit

Globe Life Whole Life Insurance

Whole life insurance will give you coverage for the lifetime. It will come with fixed premiums and it also bills cash value overtime. It is often used for long-term financial protection or as a saving tool.

Globe Life Burial Insurance

Barrier or final expend insurance will help you to pay for the funeral and end of life expenses you can qualify for these policies very easily and these plans are ideal for seniors who want peace of mind

Globe Life Accident Insurance

Accident insurance will provide you with financial support in case of any accident, injury or death. This is the additional layer of protection alongside your main life insurance policy.

Globe Life Insurance Rates And Quotes

Globe life insurance offers competitive rates for small to moderate coverage amounts. You can also request globe life insurance quotes online in a few minutes without a medical exam.

However, keep in mind that while the process is simple, rates can be slightly higher as compared to the insurance companies who require medical exams.

Sample Rate Comparison Chart

| Age | Gender | Policy Type | Coverage Amount | Globe Life Monthly Rate | Typical Competitor Rate |

| 30 | Male | Term life | $100,000 | $18 | $14 |

| 40 | Female | Term life | $150,000 | $28 | $21 |

| 55 | Male | Whole life | $50,000 | $75 | $60 |

| 65 | Female | Burial Insurance | $25,000 | $65 | $45 |

| 75 | Male | Burial Insurance | $10,000 | $110 | $80 |

How Much Is Globe Life Insurance For Seniors?

For so many seniors, global life insurance is a good option if they want simple and quick coverage without taking a medical exam the average monthly cost of seniors between age is sixty five and eighty is usually between $60 to 1 $50 but it also depends on how much coverage you choose.

There are so many seniors who pay globe life whole life insurance or Bary insurance to help pay for funeral expenses, small unpaid loans, or to leave a little money for their family. While the monthly globe life insurance payment may be a bit higher, the easy approval process and no medical exams make globe life a convenient choice for older adults.

Can You View Your Policy Details Online

Yes with your global life insurance login, you can view your full policy details online any time. Through the portal you can.

How Much Does Life Isurance Cost?

- Check payment history.

- Review policy coverage.

- Download forms or make changes.

- Update your beneficiary information

Globe Life Insurance Customer Service

If you need any help, you can contact globe life insurance customer service by calling their toll-free number at 800-831-1200. Their support team can help you with billing questions policy changes and claims. You can also reach them through the email or use the online contact form on their website.

However, there are some customers who have mentioned that it can take a while to reach a representative or get a reply. Long way times and slow responses are among the most common complaints about Globe’s life customer service

Is Global Life Insurance Legit?

Yes, globe life insurance is a legitimate and financially stable company it has an excellent rating from A.M. Best which means it has a strong financial health and ability to pay clean. The globe life insurance company has been around for decades and serves millions of policyholders nationwide.

However, like any large insurance company it has faced some controversies and makes public opinions in recent years globe life has been mentioned in news for internal review and data protection concerns, but it continues to operate successfully with millions of active policies

Low Life Insurance Reviews: What Customers Say?

Globe life insurance reviews are mixed. Many customers appreciate its fast approval process and no exam applications while others are unhappy with its billing system and customer service.

Positive reviews mention that it comes with a quick and easy online application. It also has an affordable option for smaller policies and it has convenient online bill pay and login

Negative reviews mentioned that the policy comes with the difficulty in cancelling the policies. Delays in refund or billing corrections and also long customer service response times.

Pros And Cons Of Globe Life Insurance

| Pros | Cons |

| No medical exam required | Higher premiums than some competitors |

| Fast online application and approval | Limited policy customization |

| Flexible billing and online account management | Customer service complaints are common |

| Strong financial rating (A by A.M. Best) | Aggressive marketing and direct mail advertising |

| Good for seniors or those with limited health options | Not ideal for large coverage needs |

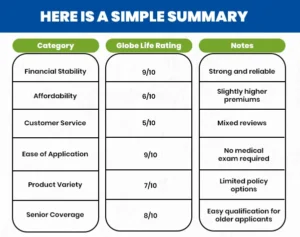

Is Global Life Insurance Good Or Bad

Whether global life insurance is good or bad depends on what you are looking for. If you want fast, no hassle coverage and don’t mind paying a little more for convenience. It will be a good option for you however, if you are healthy and looking for the best value you can find cheaper options other than this.

Final Thoughts

Global life insurance is legit, simple and easy to apply for making it a convenient choice for the people who value speed in accessibility. It is especially suited for people who want smaller coverage amounts, seniors looking for burial insurance, or anyone who prefers a non-exam policy.

However, if you were goal is to get the best price or highest flexibility you should compare quotes from other major insurance companies globe life may not always be the most affordable option but it is reliable and financially stable

If you want affordable rates, simple coverage, and excellent customer support, M-life Insurance could be the right choice for you. Get a free quote today and compare plans that fit your needs and budget. Don’t wait, protect your family’s future with Mlife Insurance now.!

FAQs

Is Globe Life insurance good or bad?

Life insurance is a good choice for the people who want simple and affordable life insurance coverage without giving any medical exam. However there are some customers who says that their customer service is a bit slow and prices can go up with the age so it comes with both good and bad sides

What happened to Globe Life insurance?

Nothing bad has happened to globe life insurance. The company is still active and continues to offer life insurance and accident insurance policies across the United States.

How much is Globe Life insurance for seniors?

For seniors aged 65 to 80 global life insurance usually cost between $60 to 1 $50 per month. It depends on the coverage amount and type of policy you choose

Can I view my Globe Life policy details online?

Yes you can easily see your policy details by logging into your globe life online account from there you can check your coverage, you can make the payments, and update your information anytime.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.