Many policyholders eventually ask an important question: Can you cash out a life insurance policy while alive? The answer depends on the type of policy you own, how long you’ve had it, and how much cash value it has accumulated. Cashing out a life insurance policy can provide access to funds, but it can also have long-term financial and tax consequences.

This comprehensive guide explains how cashing out life insurance works, which policies qualify, how much you may receive, and whether cashing out is the right decision for your financial situation.

What Is a Cash Out Life Insurance Policy?

Understanding Cash Value in Life Insurance

A cash out life insurance policy refers to a permanent life insurance policy that builds cash value over time. This cash value grows gradually as you pay premiums and can be accessed while you are still alive.

Cash value is essentially a savings component within the policy. It grows tax-deferred and belongs to the policyholder, not the insurance company.

Which Policies Have Cash Value?

Not all life insurance policies allow you to cash out. Eligible policies include:

- Whole life insurance

- Universal life insurance

- Indexed universal life insurance

- Variable life insurance

Term life insurance does not build cash value and cannot be cashed out.

Can You Cash Out a Life Insurance Policy?

When Cashing Out Is Possible

Yes, you can cash out a life insurance policy if it has accumulated sufficient cash value. The amount available depends on how long the policy has been active and how much premium has been paid.

Most policies require several years before meaningful cash value develops.

Can You Cash Out a Life Insurance Policy While Alive?

Yes, permanent life insurance policies allow access to cash value while the insured is alive. This is one of the key advantages of permanent life insurance over term policies.

Can You Cash Out a Term Life Insurance Policy?

Why Term Life Insurance Cannot Be Cashed Out

Term life insurance provides pure death benefit coverage for a specific period. It does not include a savings component, so there is no cash value to withdraw.

Exceptions to Be Aware Of

Some term policies offer riders such as:

- Return of premium riders

- Conversion options to permanent policies

Without these features, term life insurance cannot be cashed out.

How to Cash Out a Whole Life Insurance Policy

Methods to Access Cash Value

There are several ways to cash out a whole life insurance policy:

- Policy surrender – Cancel the policy and receive the remaining cash value

- Policy loan – Borrow against the cash value while keeping the policy active

- Partial withdrawal – Withdraw a portion of the cash value

Each option has different consequences for coverage and taxation.

Cashing Out Whole Life Insurance Policy Through Surrender

When you surrender the policy, coverage ends permanently. You receive the cash surrender value, which is the cash value minus any surrender charges or outstanding loans.

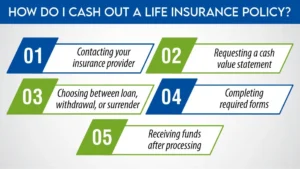

How Do I Cash Out a Life Insurance Policy?

Step-by-Step Process

The general process includes:

- Contacting your insurance provider

- Requesting a cash value statement

- Choosing between loan, withdrawal, or surrender

- Completing required forms

- Receiving funds after processing

Processing times vary by insurer.

How Much Does Life Isurance Cost?

How Much Will I Get If I Cash Out My Life Insurance Policy?

Factors That Affect Payout Amount

The amount you receive depends on:

- Policy age

- Total premiums paid

- Cash value growth

- Surrender charges

- Outstanding policy loans

What Is the Cash Value of a $10,000 Life Insurance Policy?

A $10,000 life insurance policy does not automatically mean $10,000 in cash value. Cash value depends on policy structure and duration. Early in the policy, cash value may be very low.

Is Cashing Out a Life Insurance Policy Taxable?

Understanding Life Insurance Tax Rules

Cashing out a life insurance policy may be taxable depending on how much you withdraw.

- Premiums paid = cost basis

- Cash value above cost basis = taxable income

Cashing Out a Life Insurance Policy Taxes Explained

If the cash value exceeds the total premiums paid, the excess amount is subject to income tax. Policy loans are generally not taxable unless the policy lapses.

Tax on Cashing Out Life Insurance Policy

When Taxes Apply

Taxes may apply if:

- You surrender the policy

- You withdraw more than your cost basis

- The policy lapses with an outstanding loan

How to Minimize Tax Impact

Using policy loans instead of surrendering may reduce immediate tax liability, but loans reduce the death benefit if not repaid.

Can I Cash Out My Group Life Insurance Policy?

Group Life Insurance Limitations

Most employer-provided group life insurance policies do not build cash value and cannot be cashed out. Some supplemental plans may offer limited options.

Conversion Options

Some group policies allow conversion to individual permanent coverage, which may later build cash value.

Can I Cash Out My Primerica Life Insurance Policy?

Primerica Policy Types

Primerica primarily offers term life insurance. Since term policies do not build cash value, most Primerica policies cannot be cashed out.

If converted to a permanent policy, cash value may develop over time.

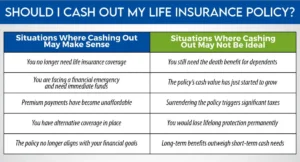

Should I Cash Out My Life Insurance Policy?

Can You Cash Out a Life Insurance Policy Early?

Early Cash Outs and Surrender Charges

Policies often include surrender charges in the early years. Cashing out too early may result in receiving less than expected.

Long-Term Perspective Matters

Permanent life insurance is designed for long-term use. Early surrender often leads to financial loss.

Alternatives to Cashing Out Life Insurance

Policy Loans

Borrowing against the policy allows you to access funds while keeping coverage active.

Partial Withdrawals

Some policies allow partial withdrawals, reducing cash value and death benefit without fully surrendering the policy.

Pros and Cons

Advantages

Cashing out can provide immediate access to funds and eliminate future premium payments.

Disadvantages

It permanently ends coverage, may trigger taxes, and eliminates long-term financial protection for beneficiaries.

Conclusion

Cashing out a life insurance policy is a significant financial decision that should not be taken lightly. While permanent life insurance offers flexibility through cash value access, surrendering a policy can result in lost coverage, tax liabilities, and reduced financial security for loved ones.

Understanding your policy type, tax implications, and long-term needs is essential before deciding whether to cash out. Consulting a qualified financial or insurance professional can help you make the most informed choice.

Thinking about cashing out your life insurance policy? M-Life Insurance helps you understand your options clearly—whether it’s accessing cash value, reducing premiums, or finding better coverage.

Speak with M-Life Insurance today for honest guidance and smart life insurance solutions that protect both your present and your future.

FAQS

It is a permanent life insurance policy that allows access to accumulated cash value while the insured is alive.

Yes, if the policy has cash value, you can access it through loans, withdrawals, or surrender.

The amount depends on cash value, premiums paid, surrender charges, and policy age.

Yes, any amount withdrawn above the total premiums paid is generally taxable.

Yes, permanent life insurance policies allow cash value access during the insured’s lifetime.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.