Last Updated on: July 21st, 2025

- Licensed Agent

- - @M-LifeInsurance

Facing the end of life is not an easy thing, but there is only thing in your hands is to plan it. It’s important for you to take time and plan for life’s final stage. When you take time to make your wishes clear, you give your loved ones a gift, that is peace of mind. They will not have to make difficult choices during a painful time, because you’ve already shared what you want. Final need planning is not just about paperwork or funeral plans. It’s about making sure your life ends with dignity and comfort.

In this guide, we’ll explain what final need planning means, why it’s important, and how you can start this. We will keep it simple and clear because this is something everyone deserves to understand.

What Is Final Need Planning?

Final need planning or end-of-life planning is a part of your estate plan. There are a lot of people in the last time of their life, who can not speak or decide what they want to happen and what they want for their family. It’s very important to keep your life on track and make plans for what will happen in the future. This means that you have to think about your health care, legal papers, money, and what you want for your funeral. It’s strange and also sad to think about these things now, but making a plan can give you peace of mind. It also reduces the pressure on your family, because they will know what you want, so they will do it accordingly.

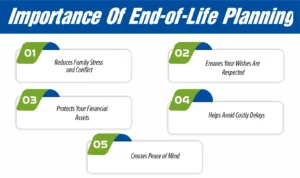

Importance Of End-of-Life Planning

Talking about death makes a lot of people sad and uncomfortable. But it’s important to plan for the end of life. Here are some of the reasons why it’s important.

1. Reduces Family Stress and Conflict

Planning for your final need is very helpful for both you and your family. The first thing is that it reduces the stress of your loved ones. If there are no clear instructions written, the family members will feel confused, and they will argue about what to do. But if there is a plan in place, everyone knows what you want and they do it accordingly to avoid misunderstanding.

2. Ensures Your Wishes Are Respected

Secondly, it will make sure that wishes are respected and fulfilled. No matter what you prefer, having a clear plan makes sure your values are considered.

3. Protects Your Financial Assets

Another important reason is that it protects your money and property. When you organize your financial and legal papers early, it makes things easier for your family. They won’t have to deal with surprise bills or extra costs after you pass away.

4. Helps Avoid Costly Delays

Final need planning also helps avoid delays. Without a plan, settling your affairs can take a long time because of legal processes like probate. Planning before saves time and keeps things simple for your family.

5. Creates Peace of Mind

The final need planning gives peace of mind. You already know that things are safe and secure, and your family will be stress-free. Also, everyone feels more at ease when they don’t have to worry about what to do during the tough times.

How to Start Planning for the End of Life

Starting the planning can be very emotional and a bit difficult for you, but breaking it into simple steps can make it manageable for you. The first thing you have to do is consider healthcare preferences, your beliefs, what you want to leave behind, and how you want people to remember you. After this, the second thing to do is to talk to your family, like your husband or wife, kids, or anyone else who is important to you, and let them know what you want.

Then you have to get help from the professionals to make sure things go smoothly. Once you know what you want, start writing it down. Having everything on paper helps make sure your wishes are followed. We’ll go over those important documents next.

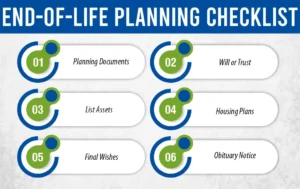

End-of-Life Planning Checklist

Use this easy end-of-life planning checklist to keep things in order and make sure you don’t forget anything important.

- Prepare end-of-life planning documents.

- Decide between a Will or a Trust

- Make a list of your assets

- Determine end-of-life housing plans

- Write down your final wishes, including funeral plans and burial arrangements.

- Create an obituary and/or death notice

Let’s have a look at the details of how to make and manage all these documents.

Planning Documents

Planning documents are the first step. You have to start by preparing the important legal documents. These documents include a will, a power of attorney, and a health care directive. All the documents must be signed, and you have to keep them safe and update them regularly, especially when there is a big change in your life.

Will or Trust

The most important step in your planning is to decide between a will and a trust. A will is a legal document, and it is written who will receive your belongings after you die. Will is simple and affordable to create. On the other hand, trust is a way to give your things without going through court. This lets you decide exactly when and how your money and property are shared. If you have a lot to give in a clear way, trust is a better choice.

List Assets

Make a list of everything you own, and also remember to list your online things, like your accounts or any other valuable things. Keep this list neat and update it after some time. This will make it easier for your family to know what you have and where to find it.

How Much Does Life Isurance Cost?

Housing Plans

It’s good to plan if your health changes and you are thinking about how you want to live during the last years. You may want to stay home with help from family or a caregiver. Plan about what type of care you need. This will help you avoid rushed decisions.

Final Wishes

Write down how you want your funeral or memorial service to be handled. Include your preferences for:

- Burial or cremation

- Religious or spiritual rites

- Music, readings, or people you would like involved

Obituary Notice

Writing the obituary before the time is a kind way. You can write whatever you want to. This includes your life’s big moments and special memories with your family members. This gives your family something to work with, so they don’t have to write everything while feeling sad.

Final Thoughts

End-of-life planning can feel hard and sad, but it is a loving gift to your family. It’s not just about planning for death. It’s more about making sure that your life ends the way you want. Making the choices for your assets now will make you feel more relaxed later. It does not matter what your age is; you can start it whenever you want. Just make sure to talk with your loved ones and slowly make a plan. The above checklist also helps you to take the first steps.

Start Planning Today

Don’t wait for the “right time”—start your final need planning today with us. Use our checklist as your guide, talk to your loved ones, and take the first small step.

FAQs

1. What is end-of-life planning?

End-of-life planning means you are getting ready for the last stage of your life. You have to make decisions about your money, property, health care, and personal wishes.

2. Why is end-of-life planning important?

End of life planning is important because it reduces stress and makes sure your money and property are protected from any legal problems

3. How to start planning for the end of life?

Think about what’s most important to you. Talk with your family, ask experts for help, and write down your wishes in things like a will or a health care form.

4. What is the final step of final need planning?

The final stage includes legal finalization, secure document storage, finalizing financial arrangements, and communicating your plan with your family.