Key Points

- Extra financial protection

- Reduces out-of-pocket costs

- Complements primary coverage

- Ideal for seniors and Medicare users

- Customizable plan options

- Available at affordable rates.

Health insurance is one of the most important ways to protect yourself in your family from the expensive medical bills. But what if your main insurance does not cover everything that’s where the secondary insurance for health comes in and can save you your future and family.

Secondary insurance for health can help you to pay for the remaining cost after your primary insurance has paid its part.

In this guide, we will explain what secondary insurance is, how it works and what are the main benefits. You can also learn how you can get the best secondary insurance plan for your needs.

Secondary Health Insurance – Basics

Secondary health insurance is an additional health policy that will work together with your main insurance plan. When you have both, your primary insurance space first for any medical bills then your secondary insurance will help you to cover the expenses such as copayments, deductible or service that is not fully covered by your main plan

For example, if your hospital bill is $5000 in your primary income covers $4000 then your secondary insurance can help to pay the part of all the remaining $1000

People often be by secondary insurance for these things

- Extra financial protection

- Coverage for out-of-pocket costs

- Specific medical needs like dental or vision care

- Supplementing the Medicare or employer insurance

How Does Secondary Insurance Work?

Many people think about how this secondary insurance will work if they buy it. Here is how it actually works and you will better understand by these steps.

- You receive a medical treatment

- Your primary insurance is built first and pay according to its terms

- Your secondary insurance is built afterward for any remaining balance

- You can still pay a small amount of both insurances does not cover everything

This system will help you to avoid large medical expenses and make sure that you get the maximum coverage

Primary vs Secondary Insurance

Let’s understand the difference between primary and secondary insurance by the chart;

| Type | Who Pays First | Example |

| Primary Insurance | Pays the main share of your medical bill | Employer-provided health plan |

| Secondary Insurance | Pays after the primary insurance | Medicare supplement or private policy |

Sometimes people have two policies, for example, the one policy is for their employer and another policy from their spouse employer. In this case, the one becomes the primary and the second act as a secondary recovery.

Benefits of Secondary Insurance

Having a secondary health plan gives you so many advantages. There are some of the main benefits of secondary insurance for health.

Lower out of Pocket Cost

It covers co-pays, coinsurance and deductibles

Extra Protection

It also offers added financial security against the large medical bills

More Coverage Option

It can conclude the vision, dental or prescription drug coverage

Peace of mind

It gives you peace of mind by helping to reduce financial stress during the emergencies

Support With Medicare

Work well and secondary insurance for Medicare recipients.

Who Needs Secondary Insurance?

I think a secondary insurance plan gives you so many benefits and this plan is not just for the elderly. It can help everyone who wants stronger coverage or has frequent medical expenses.

How Much Does Life Isurance Cost?

You can need secondary insurance if

- Your primary insurance does not cover enough costs

- You want to reduce out of pocket cost

- You are on a Medicare and need a supplement plan

- You want extra coverage for dental, vision or critical illness

- You have multiple employers or policies

Secondary Health Insurance for Medicare

For all the senior secondary insurance, especially important. Medicare covers so many healthcare services but not everything. You might still pay deductible, coinsurance or drug costs.

To fill out these caps, there are so many seniors who buy Medicare supplement insurance that is also known as Medica. This is a type of secondary health insurance for Medicare that help to pay for the parts Medicare does not cover

There are also Medicare advantage plans and prescription drug plants which can act as secondary or additional coverage depending on your situation.

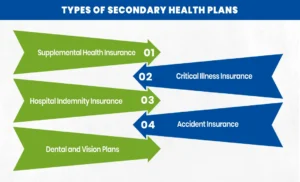

Types of Secondary Health Plans

There are many types of secondary insurance plans you can choose from, depending on your needs and budget:

Supplemental Health Insurance

This type will cover the deductibles and copayments

Critical Illness Insurance

It provides a lump sum if you are diagnosed with a serious illness like cancer or heart disease

Hospital Indemnity Insurance

This type will pay daily benefits if you are hospitalised

Accident Insurance

This insurance plan will help to cover the cost from injuries or accident

Dental and Vision Plans

It will add the coverage for oral and eyecare not included in your main policy

How to Get Secondary Insurance

My secondary health insurance is easy if you know where to start. Here are a few of the steps to follow.

Check your current coverage

Review what your primary insurance included and identify the gaps.

Compare plans

Look for the secondary insurance plan that fill those gaps

Request quotes

Compare the prices and benefits from different secondary insurance companies

Read Policy Details Carefully

Read the policy very carefully to Understand what is covered and what is not covered in this plan.

Purchase Your Plan

You can buy the secondary health insurance online or through an insurance agent.

Best Secondary Health Insurance Plans and Companies

When choosing the best secondary health insurance plan you have to look for the companies that have the strong customer service, flexible coverage options and good clean response times.

Some of the best secondary health insurance companies include

- Aflac that is known for accident and supplemental plans

- UnitedHealthCare that is best for Medicare supplement and extra benefits

- Cigna, that provides a dental, vision and critical illness coverage

- Humana that is popular among seniors for medicare related plans

- Blue Cross Blue Shield, that will offer a wide range of secondary plans nationwide

What Does Secondary Insurance Cover?

Coverage depends on the type of brand you buy, but in general, secondary insurance can pay for these things

- Detectives and copayments

- Hospital stays and surgeries

- Emergency room visits

- Prescription drugs

- Dental and vision care

- Critical illness benefits

Affordable and Cheap Secondary Insurance

If you’re on the type budget you don’t have to worry, you can still find cheap secondary health insurance plans by comparing the companies quotes online, choosing a higher detectable plan, bending your insurance policies and asking your employer if secondary plans are available or not.

Affordable does not mean low quality. It means that there are so many companies that offer cost effective coverage with reliable benefits.

Final Thoughts

Having a secondary health insurance is a smart way to protect yourself from unexpected medical bills. It works alongside your main insurance policy, filling coverage caps and lowering your out of pocket expenses. With the right secondary plan, you can enjoy a piece of mind knowing that you are fully covered no matter what happens in future.

Make sure to always compare the prices before choosing and buying any plan so it will be easy for you to get the best plan.

Your peace of mind starts here, let M-Life Insurance protect your family by offering you the best plans.

FAQS

Secondary health insurance for the second insurance plan that will help to pay the cost your main health insurance does not cover

You can get secondary insurance and few simple ways like you have to buy directly from a health insurance company, ask your employer if the offer is an extra benefit, added through your spouse plan or get it online

Secondary insurance work after your primary health insurance has paid it’s here. Here is how it goes, you visit a doctor or hospital, your primary insurance space first then your second secondary insurance will pay the remaining amount.

Yes, you can buy secondary insurance if you already have a main health insurance plan. You just need to check that your current insurance company allows coordination with another plan.

Yes, you can get the secondary insurance plan. You can purchase it online, through an insurance agent or directly from the insurance companies.

The best secondary medical health insurance depends on your need and budget. You have to look for the plan that cover what your main plan does not cover, I have low monthly cost but good coverage and offer you easy clean processing.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.